The Balance-Sheet Model of the Firm

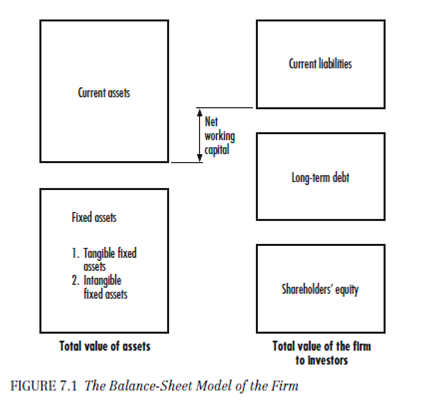

Assume we obtain a financial snapshot of the firm at a solitary position in time. The snapshot should enclose a digest of all of the speculation and financing decisions made by a firm throughout its pertinent history. This in sequence is restricted in a firm's balance sheet which shows where and how the organizations raised its money and how it has exhausted it. Figure shows a graphic conceptualization of the balance sheet that will help initiate you to corporate finance.

The possessions of the firm are on the left-hand side of the balance sheet. Possessions symbolize how a firm has exhausted its time and money, and are typically categorize as either present or fixed. Fixed assets are those that will last a long time, such as a structure. Some fixed possessions are concrete, such as machinery and apparatus. Other fixed assets are intangible, such as patents, trademarks, and the quality of management. The other category of assets, present assets, comprises those that have short lives, such as register or accounts receivable. The harvest that your firm has made but has not yet sold is part of its inventory. Unless you have overproduced, the goods will finally be sold. At that time, one asset will be changed into another.

Before a organization can spend in an benefit, it must gain funding, which means that it must raise the money to pay for the investment. Many firms obtain funding from a selection of various sources. The right-hand side of a firm's balance sheet occasionally summarizes the outstanding various types of financing the firm has used, and hence we often detect a number of sources rather than just a single supplier. A firm will matter (sell) pieces of paper called debt (loan agreements) or evenhandedness shares (stock certificates). Debt obligations are allocated to creditors, and the shareholders are the debtors. Typically, however, shareholders have the accurate of incomplete legal responsibility, which means they are not in my opinion accountable for repaying the firm's credit obligations. Therefore, lenders base their loan decisions on the foundation of their evaluation of the corporation's aptitude (and willingness) to reimburse its credit obligations. Liabilities, like possessions, are long-lasting or short-term. A short-term loan or debt responsibility is called a current liability. Temporary arrears represent loans and other obligations that must be repaid within one year. Long-standing arrears are debt that does not have to be repaid within one year. Shareholders' impartiality represents the dissimilarity between the value of the possessions and the arrears of the firm. These are the claims held by the owners of the corporation. In this sense it is considered a remaining claim on the firm's belongings. That is, shareholders get compensated only after all other financial obligations of the firm have been content.

From the balance-sheet representation of the firm it is simple to see why financial organization can be thought of as answering the following three questions:

1. In what long-lived fixed possessions should the firm spend its financial possessions? This question concerns the left-hand side of the balance sheet. Of course, the nature of the business the firm has chosen to operate in typically determines the type and extent of assets the firm wants. We use the provisions capital budget and capital disbursement to explain the process of commits investment capital and organization expenditures on long-lived assets. An example would be whether Ben & Jerry's should build a new developed plant to meet the predictable increase in requiring for its ice cream products.

2. How should the firm elevate the cash necessary to finance its capital expenditures? This question concerns the right- hand side of the balance sheet. These decisions institute the firm's capital structure, which present the extent of the firm's financing from present and long-term debt and evenhandedness. Continuing with our Ben & Jerry's plant expansion decision, if the management decides to continue with its planned capital spending, should it issue debt or evenhandedness to finance the project?

3. How should temporary operating cash flows be managed?

This question concerns the greater segment of the balance sheet. Depending on the industry in which a firm operates, there may be a disparity stuck between the timing of cash inflows and cash outflows throughout its in use cycle. Furthermore, neither the amount nor the timing of in commission cash inflows and outflows are known with assurance. Financial managers must begin policies and events to administer the provisional shortfalls (or overload inflows) in cash flow. Short-term management of cash flow is described by a firm's net working capital location. Net working capital is definite as current assets deficiency current liability. From a financial viewpoint, the short-term cash flow difficulty comes from the mismatching of cash inflows and outflows. It is the theme of short-term finance. Decision such as how much register to carry and how much client credit should be extensive are typical problems addressed here.