Expected utility theory and risk aversion:

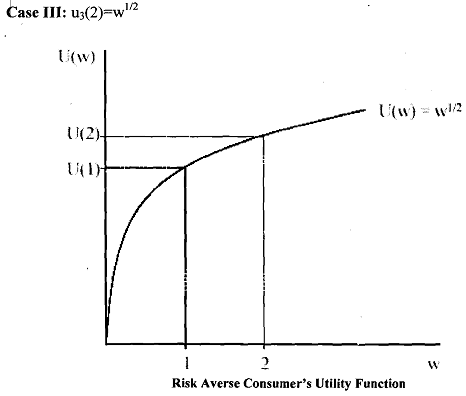

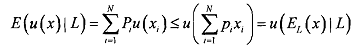

Let us extend the discussion of expected utility preferences to link with risk aversion. Note that ordinarily people dislike risk. Therefore, we can ask, how much a consumer would be willing to pay to avoid a fair bet. A fair oet is a lottery whose expected payoff is equal to zero. With such payoff, you either gain or lose money by playing them. That means, such lotteries expose you to risk, and we are trying to measure the aversion to such types of risk. We conceive of concavity or convexity form of a vNM utility function where properties that are not generally preserved by arbitrary monotonic transformation. Then it will be possible to see that they cany a lot of information about individual attitude to risk. You can consider Jensen's inequality for that purpose which tells us that for any concave u ,

That is, an individual, whose preferences are represented by a concave utility function prefers to have the amount of money equal to the expected value of the lottery to having the lottery itself. Such an individual is known as risk- averse individual.

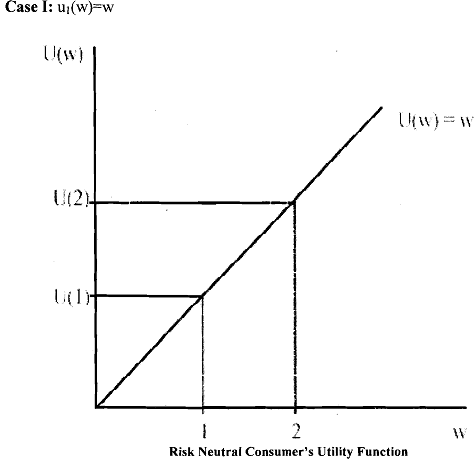

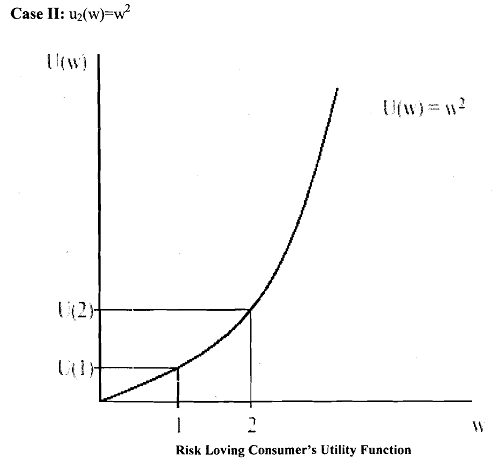

The above inequality is reversed for convex u and the individual will be called risk-loving individual. Finally, when u is linear, (i.e., u(x)=x),individual will consider only about the expected value of the lottery and will be indifferent to risk. In such a situation, she will be known as risk- neutral individual.

Consider the following three utility functions (due to Autor, 2004) characterising three different expected utility maximiser: