Risk aversion and insurance:

We have drawn mostly from Autor, 2004 for developing this section. Consider insurance that is actuarially fair, meaning that the premium is equal to expected claims: Premium = (pA) where p is the expected probability of a claim, and A is the amount of the claim in even of an accident.

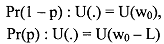

We start with a risk-averse person's decision to buy insurance by taking the initial endowment wealth wo, where L is the amount of the loss from an accident

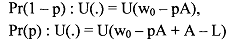

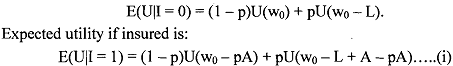

If insured, the endowment is (incorporation the premium PA, the claim paid A if a claim is made, and the loss L):

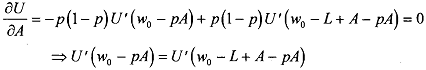

We need to find out the amount of insurance that should be bought. See that the insurance can be bought they could buy upto their total wealth: wo - pL. To solve for the optimal policy that the agent should purchase, differentiate (i) with respect to A:

=> A = L, which implies that wealth is wo - L in both states of the world (insurance claim or no claim) Thus, a risk averse person will optimally buy full insurance if the insurance is actuarially fair. You can verify that for this kind of a consumer the expected utility rises with the purchase of insurance although expected wealth is unchanged.

Next, let us solve for how much the consumer would be willing to pay for a given insurance policy. Since insurance increases the consumer's welfare, she would be willing to pay some positive price in excess of the actuarially fair premium to defray risk. Thus, the agent is trying to equate the marginal utility of wealth across states. Because, the utility of average wealth is greater than the average utility of wealth for a risk averse agent.

The agent wants to distribute wealth evenly across states of the world, rather than concentrate wealth in one state. She will attempt to maintain wealth at the same level in all states of the world, assuming that she can costlessly transfer wealth between states of the world (which is what actuarially fair insurance allows the agent to do).

The above formulation of insurance problem is exactly analogous to convex indifference curves over consumption bundles. It can be seen that diminishing marginal rate of substitution across goods, which comes from diminishing marginal utility of consumption, causes consumer's to diversify across gods rather than specialize in single good; and diminishing marginal utility of wealth causes consumers to wish to diversify wealth across possible states of the world rather than concentrate it in one state. The insurance problem would change if the consumer were risk loving. Such an individual would like to be at a comer solution where all risk is transferred to the least probable state the worlci, again holding constant expected wealth.