Arrow-Pratt Coefficient of Risk Aversion:

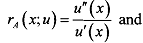

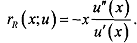

The measure of absolute risk aversion is given by

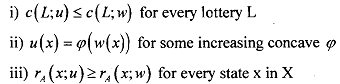

the following three statements are equivalent

With the above conditions, it will be possible for you to conclude that individual with vNM within function u is more risk averse than the one with vNM utility function w.

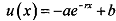

You should keep in mind that this is only an incomplete ranking and it is possible that you can't compare two risk-averse individuals in this way. However, within an important subclass of utility functions, known as constant absolute risk-aversion (CARA) utility functions, the ranking is complete. These are the utility functions of the form

for these, the coefficient of absolute risk-aversion

There is a problem with CARA utility functions, however.absolute risk-averse individuals are concerned only with absolute size of the risk they are exposed to. Whether a possible loss of Rs. 1000 represents .5%, 5%. or 50% of her net worth, an individual with CARA preferences will view it in the same manner. Therefore, it may be useful to consider the Arrow-Pratt coefficient of relative risk-aversion, which can be written as

This formulation focuses on the size of the gamble as a proportion of one's wealth and constant relative risk-aversion implies decreasing absolute risk- aversion.

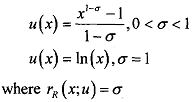

You will be dealing, mostly, with the constant relative risk-aversion (CRRA) utility functions of the form,