Money markets:

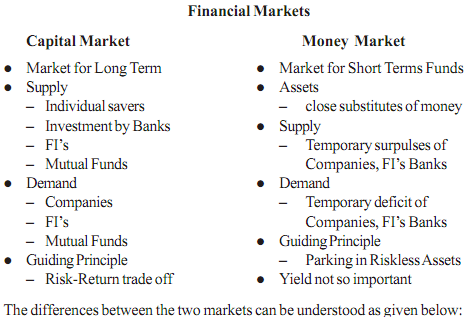

Debt market is generally understood as comprising the money market (short-term debt, maturity of one year or less) and the capital market (long-term debt). This distinction is made as the two sectors are driven different market forces and serve different needs of the market players. This Unit is a discussion about the nature, functioning and the developments of Money Market.

Banks and Financial Institutions, even though they plan their cash-flows meticulously, usually find that on any day their actual cash inflows and cash outflows do not match. They have either a cash short fall or cash excess. By nature these are of short-term

nature. Though this happens in the case of all enterprises, it is manageable for commercial enterprises as they depend on their banks. However, banks and financial institutions that have temporary shortages cannot postpone their liabilities and have to meet these liabilities; default by them would result on a run on the banks. On the other hand banks and financial institutions which have temporary surpluses are on the look out for very short term investment opportunities. But, these should be very safe or risk-less. Any default or even a day's delay would land the banks and financial institutions in unnecessary trouble. One has to remember that these "investments" are not really investments but are by nature deployment of temporary funds in search of some return. We can say that these are parking of funds for a short time till required. Thus investments in money market are not made using the universal rule of "trade-off between risk and return". But, on the other hand, it a market for funds

seeking safe or riskless avenues. Money markets are different from capital markets.