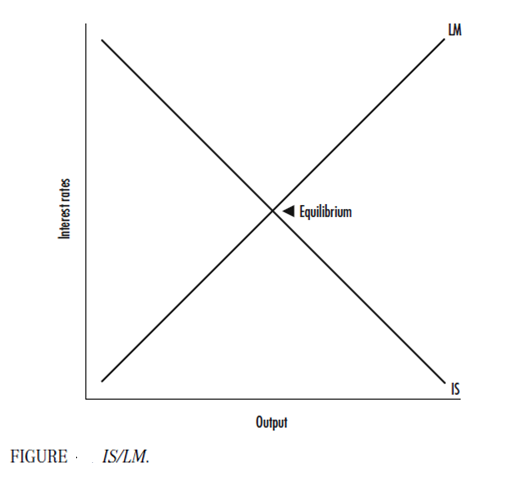

The IS/LM Curves: Managing Supply and Demand

The federal government, through the Fed, changes the money supply in an endeavor to control the country's economic situation. An augment in the money supply will reduce the cost of money and there- fore augment the demand for money. Prices and wages, how- ever, takes a long time to respond to changes in the money supply? Thus, in the short term, the Fed can amplify demand without distressing prices. This is known as Keynesian economics, which summarize the dense relationship between money sup- ply, command, and output in an economy through the use of IS/LM analyses. IS/LM analysis graphically shows how altering the money supply will influence the economy.

The speculation and savings curve (IS) represents the different combinations of total output and curiosity rates such that the total amount of goods produced equals the total number of goods demanded, or that combination of output and interest rates that attain market equilibrium. Simply put, it is the curvature on which the supply of goods equals the stipulate for supplies. Remember that GDP is the total value of all final goods and services shaped by a country over a period of time. This is the provider of goods fashioned by the country. Goods not inspired in the home country are exported, and excess demand results in the introduction of goods. Thus the IS curve is inextricably connected to both GDP and insist for merchandise.

The LM curve, alternatively, represent the combination of total production and attention rates such that the total amount of money demand generation the measure of money complete, or those combination of output and attention rates that attain money-market equilibrium. L is a function on behalf of the command for money and M is the currency contributes. Simply put, the LM curve is where the supply of money generation requires.

Taken mutually, the IS/LM curves interconnect at a point (point x, as labeled on the chart) that indicates the equilibrium levels for collective output as well as for curiosity rates such that both goods market symmetry and money market stability are achieved and maintain. Thus the IS/LM curve indicates where goods, and money accessible to purchase these goods, are in symmetry. Moreover, the IS/LM analysis illustrate the inextricable relationship between concentration rates, the money supply, and GDP. This framework is a controlling tool for considerate the key fundamentals of macroeconomics.