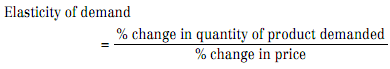

Elasticity of Demand

Elasticity of require refers to modify in performance of buyers when there is a change in the value of a product. More purposely, elasticity of require is calculated as:

Under the most essential circumstances, provide and command curves accessible show that buyers are in a straight line responsive to price, such that the subordinate the price of an item, the greater the measure of the item the buyers are willing to purchase, and vice versa. There are conditions, however, when the relation- ship of price to measure is not so direct, nor is selling fewer units of a product unavoidably a unenthusiastic outcome. For example, the price of some luxury items increases proportionally to their scarcity. Thus producing smaller amount of the luxury good can be more money-making than producing more.

Consider the proceeds equation:

Revenue = price * quantity

Every manager's goal is to maximize proceeds. The thought of demand suppleness means that an incremental increase in price does not unavoidably result in an identical decrease in the number sold, where the net change in proceeds is zero.

An incremental increase in price, while it might punctual a decrease in demand, can punctual a lesser reduce incrementally, ensuing in an overall increase in proceeds. For example, returning to the hot dog stand, let's understand we sell 40 hot dogs a day at $5, but only 37 hot dogs per day at $7. Though the volume decreases, the profit increases from $120 to $128.

40 hot dogs at $5 37 hot dogs at $7

120 = ($5 * 40) 128 = ($7 * 37 )

- [($3 * 40) + 20] - [($3 * 37 ) + 20]

120 = $200 - [60 + 20] 128 = $259 - [111 + 20]

120 = $200 - $80 128 = $259 - $131

While the concept of suppleness is a useful one, it merely isn't time-competent for managers to haphazardly choose prices for foodstuffs until revenue is maximized. Fortunately, there is a more systematic way to optimize profit.