Choice in uncertain situations:

In the presence of uncertain situations, people tend to show some behavioural traits. Look at the following observations:

1) People often do not want to play actuarially fair games.

2) People won't necessarily play actuarially favourable games.

3) People would not pay large amounts of money to play gambles with huge upside potential.

Example

Suppose Rita and Sita agree to flip a coin one time. If a head comes up, Rita will pay Sita Re. 1; in the event of the appearance of a tail Sita will pay Rita Re. 1. Try to understand this game taking Rita's view points. She expects two prizes available in the game:

X1 head prize -+ her payoff = -1, (as she loses Re. 1)

X2 tail prize -+ her payoff = +1 (as she wins Re. 1).

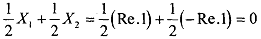

Expectations of the other player also run in the same line except for the reversed values of XI and X2. Thus, the expected value of this game is

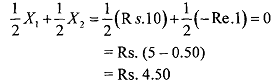

Remember that even when this game is played a number of times, the expected gains of the participants will not change. Change this game slightly to assign X1 = Rs.10 and X2 = Re.1. Its expected value is

When this game is played a large number of times, Sita will be a distinct gainer. Perhaps, Sita could pay Rita a small amount as an entry fee to participate in the game. In both its versions, the above game is called an actuariallyfair game. It is observed that in many situations, people refuse to play actuarially fair games. One way of appreciating above idea is to note your reaction if you are invited to participate in the above game with a bait of Rs. 10,000 instead of Re. 1. You will, in all likelihood, decline to accept the offer. People often avoid playing games with bigger risk even if these are fair ones. For a formal treatment of the theme, it will be useful to touch upon the St. Petersburg Paradox.