Testing for structural stability:

In the regression Aodels $hat have been discussed so far in the present unit we have considered that the qualitative variables affect the intercept term only but not the slope coefficient. but what happens if the slope coefficients are also affected by the qualitative variables? In such- situations testing for the differences in the intercepts alone will be of little significance. Therefore, we need to look for a methodology that will identify whether the differences in two or more regressions are due to differences in the intercept, or slopes or both slope and intercept. In order t6 understand this problem let us consider the following example.

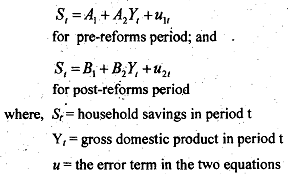

One way of testing whether the savings function has undergone a structural change is to use the techniques of Chow test which has been discussed in details. Following the procedure of chow test we divide the time period 1980-81 to 2002-03 into two periods: pre-reforms period (1980-81 to 1991-92) and post-reforms period (1992-93 to 2002-03). The savings function for the two periods would now be written as

The Chew test would tell us whether there was a structural change in the saving- income lat ti on ship over the concerned period. However, what it will not tell us whether the differences in the two regression'models is in their intercept values or the slope value or both. Comparing the two models we see that there are four possibilities: '(these possibilities are illustrated in Fig)

a) A1= B1and A2≠ B2 i.e., the two regressions are identical. This is the cpse of coincident regression.

b) A1≠ B1, but A2≠ B2 i.e., the two regressions differ only in their localion or the intercepts. This is a case of parallel regression.

c) A1= B1, but A2≠ B2 i.e., the two regressions have same, interdept term butL different - slopes. This is a case of concurrent regreksion and

d) A1≠ B1, but A2≠ B2; i.e., the two regressions are completely different. This is a case of dissimilar regression.