Properties of the expected utility function:

There are certain properties of the expected utility function. The first is that more is preferred to less, that is, the utility function is an upward sloping function of wealth. The first derivative of utility with respect to wealth is positive. The second property of a utility function is an assumption regarding an investor's taste for risk. An investor can be risk averse, be neutral to risk or a risk lover, that is, risk seeker. These can be explained in terms of a fair gamble. A fair gamble is one where the expected returns are equal to the cost of undertaking the gamble. For example, let the cost of playing the gamble be rupee 1. let there be a 0.5 chance of winning rupee 2 and 0.5 chance of winning nothing. We can see that the expected value of winning is 0.5 X 2 + 0.5 X 0 = 1, which is equal to the cost of playing. If the person does not undertake the gamble he retains rupee 1 with certainty. Since the expected value of winning equals the cost, it is called a fair gamble.

Risk aversion means that an investor will reject a fair gamble because the disutility of loss is greater than the utility of an equivalent win. Utility functions that exhibit this property have a negative second derivative of utility with respect to wealth. This

means the utility function is upward sloping but concave to the origin.

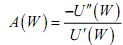

The third property of utility functions is an assumption about how the investor's preferences change with a change in wealth. We ask whether, as the investor's wealth increases, will she invest less or more of that wealth in risky assets? If the investor increases the absolute amount invested in risky assets as her wealth increases, then the investor is said to exhibit decreasing absolute risk aversion. If the absolute amount invested in risky assets remains constant as wealth increases the investor is said to display constant absolute risk aversion. Similarly for increasing absolute risk aversion. If wealth is shown by W, and and are first and second derivatives of utility with respect to wealth, then a measure of absolute risk aversion is given by

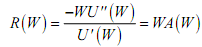

The final property of the characteristic of the utility function or you may say the final restriction on the investor's utility function is to see how the percentage or proportion of wealth invested in risky assets changes as wealth increases. If this percentage increases as wealth of the investor increase, the investor is said to display decreasing relative risk aversion. You can work out the cases of increasing and constant relative risk aversion. Relative risk aversion is closely related to absolute risk aversion. The measure of relative risk aversion is

If R/(W) is negative it indicates the utility function shows decreasing relative risk aversion. Similarly for R/ (W) >0 and R/ (W) = 0.

We have mentioned about decision-making under uncertainty. We have also seen in the previous section the uses of diversification. Here we just touch upon, as a way of closing our discussion, the benefits of diversification and risk spreading, and briefly mention an institution that helps in spreading and transferring risks: the stock market. The stock market plays a role similar to insurance. The stock market (primary market) allows the original owners of a firm to convert their stream of returns over time to a lump sum. The original owners of a firm can spread their risks by issuing shares to a very large number of people. Moreover, all the wealth of the original owners need not be tied up in a single enterprise: once the stock market has allowed them to convert their stream of returns to a lump sum, they can use it to invest in a variety of assets.