Current yield and yield to maturity:

The trading of bonds is usually based on their prices. But since there are significant differences in cash flow patterns, and also other features, of different bonds, different bonds are not usually compared in terms of their prices. Instead, the point of comparison is bond yields. We now turn to some measures of bond yields. A common measure of yield is the current yield, which relates the annual coupon interest to the market price. It is expressed as:

Current Yield = Annual Interest / Price.

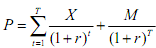

The current yield does not consider the capital gain (or loss) that the investor will face if she holds the bond till maturity and sell at a premium (or discount). This measure also neglects the time value of money. The next measure of yield that we consider is the yield to maturity. This is that value of the rate of interest that makes the present value of the cash stream received from owning the bond equal to the price of the bond. It can be expressed as

Where P is the price of the bond, and the other letters denote the same variable as in the previous equation. Sometimes the calculation of r in the above is difficult and a trial-and-error procedure is resorted to. The final measure of yield that we consider is the yield to call. It is calculated in the same way as yield to maturity, except that in yield to call, instead of maturity value at the end, there is call price and the duration, instead of going from say, 1 to T, goes from 1 to the number of years until the assumed call date.