Debt ratio and Cash Flow Coverage:

By debt, here we mean the firm's current liabilities as well as long run debt. The debt ratio is defined as:

Debt ratio = Total Liabilities divided by Total Assets

The debt-equity ratio is defined as:

Debt-equity ratio = Total Liabilities divided by Equities

Now since total assets equal total liabilities plus equity, it can be shown (it is left to you as an exercise) that:

Debt-equity ratio = Debt ratio divided by (1 - Debt Ratio)

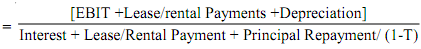

From the income statements we can derive the firm's cash flow coverage, which is given as: Cash Flow Coverage

Where EBIT stands for annual earnings before interest and taxes, and T stands for taxes on a firm.

Finally we discuss profitability ratios. These ratios allow the shareholders to evaluate management's performance. There are two types of profitability ratios used: profit margin on sales, and returns on assets employed. Profit margins- type of profitability ratios look at a firm's expenditure in relation to sales. There are two important such ratios: gross profit margin and net profit margin. They are defined as follows:

Gross Profit Margin = gross Profits/Net Sales

Net Profit Margin = Net Income/Net Sales

In addition, we can work out the operating profit margin which is defined as:

Operating profit margin = EBIT/Net Sales.

In addition to looking at ratios related to the profit margin, we can relate returns to assets and shareholders equity. Two ratios frequently used are (ROA) , also known as return on investment (ROI), and return on equity (ROE).

They are defined as:

Return on Assets = Net Income/Total Assets

Return on Equity = Net Income/Shareholders' Equity

Equipped with these ratios, we now discuss, somewhat briefly, some elements of capital structure of a firm. The central question is: can the firm create value by carefully selecting its debt-equity mix? There are two lines of thought on this: the first one says that capital structure is irrelevant, because the value of the firm is determined by the yield on the company's real assets and working on the claims on these assets does not change their total value. The other line of thinking says that in the real world, there are taxes and other distortions, and hence an optimal degree of debt-equity ratio, that is, leverage, and hence firms can raise their debt to equity ratio up to a point.