Capital structure of a firm:

We now turn to alternative theories of the capital structure of a firm. We just saw that leverage can have both positive and negative effects. Is there then an optimal level of leverage? The traditional thinking on this was that since leverage substitutes debt for equity, what happens is that as the proportion of debt increases, the proportion of cheaper credit increases while that of more expensive equity decreases, and hence, the firm's weighted average cost of capital (average of debt and equity)

declines. This means that the total value of the firm goes up.

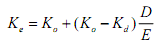

This traditional view was challenged in a remarkable article by Franco Modigliani and Merton Miller in 1958 published in the Americann Economic review. They demonstrated that if we assume that there are no taxes, transactions cost and other market distortions, then the capital structure does not matter. This paper set the stage for financial discipline to acquire a rigorous theoretical edge and no longer be informed by accountancy practices and anecdotal evidence, but be based on mathematical economics and empirical studies. Modigliani-Miller's first proposition is that the value of the firm is independent of its capital structure. Their second proposition is that the cost of equity capital for a leveraged firm is equal to the constant overall cost of capital plus a risk premium. This risk premium itself is equal to the difference between the overall cost of capital and cost of debt multiplied by the debt-equity ratio. Symbolically, it can be shown as:

where Ke is cost of equity capital

Kd is cost of debt capital

Ko is the overall cost of capital, that is, the weighted average cost of capital.

Their first proposition is based on an arbitrage kind of argument. It suggests that in equilibrium identical assets must sell for identical prices, regardless of how they are financed. This arbitrage type of assumption, together with the assumption that the firm's operating cash flow is independent of its capital structure, gives rise to the first proposition.