Interest During Construction (IDC):

This is a main cost head, second only to primary equipment cost. This was so far not extremely prominent in power project cost estimates at Utilities as the finances were provided through the Government. With debt financing in electricity sector a reality and financial institutions becoming main financers, this element will now become prominent contributor to the project cost. The first and foremost step while calculating the IDC is to know the financing pattern. The last applicable pattern for financing the power distribution schemes is given in Table.

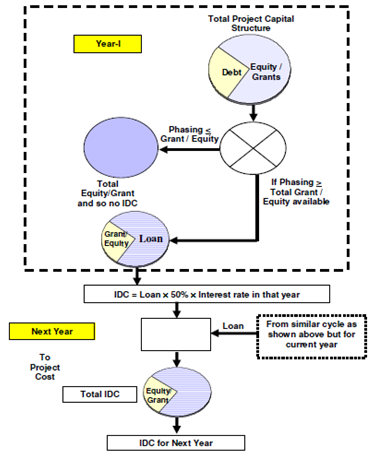

It is the loan element of the project finance which attracts interest during construction. It is capitalized and fused along with capital investment and treated as part and parcel of capital investment for any subsequent use. The other step is to know the phasing of capital expenditure, that is, the withdrawal pattern of funds. This aspect becomes significantly significant while the implementation schedule spills beyond one year. The phasing pattern follows generally the typical parabolic distribution. The fund deployment starts along with equity/grant and loan is resorted to only while the former exhausts. This is a common convention and there could be other patterns of withdrawal of funds. A typical sequential representation of IDC calculation is given in Figure.

Figure: Representation of IDC Calculations