Use of Monetary Policy:

Monetary policy is that part of macroeconomic policy which regulates the changes in money supply in order to maintain price stability.

Tools of monetary policy are changing discount rate (d); changing required reserve ratio (rr) reduces the extent to which commercial banks create credit hence reduces money supply. When the discount rate is increased short term interest rates increase and this discourages borrowing to finance investment spending. This invariably reduces aggregate demand. Central bank selling of its own government securities to the general public reduces money supply which reduces aggregate demand. Generally, there will be contractionary monetary policy.

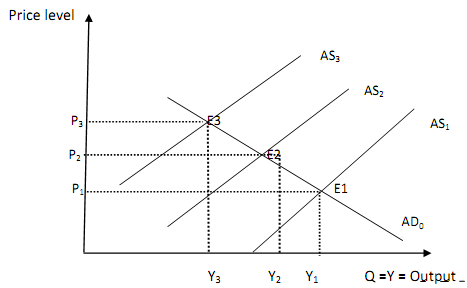

We employ Figure to illustrate how monetary and fiscal policies shift the aggregate demand curve.

In the mainstream macroeconomics, monetary policy shifts the aggregate demand curve of an economy.

In Figure, the equilibrium price level is P0 and the equilibrium aggregate output is Y0. If the central bank increases the discount rate (d) or engages in open market sales or increases the required reserve ratio the AD-curve shifts to the left (aggregate demand falls) from AD0 to AD1 and the price level declines to P1 o. This is known as restrictive monetary policy. The central bank in an attempt to fight inflation may embark on restrictive monetary policy.

Contractionary fiscal policy via reduction in government expenditure (G), decrease in transfer payments (Tr) and increase in the income tax rate (t), would also cause the AD0 to shift to AD1.