Third model model of Chamberlin:

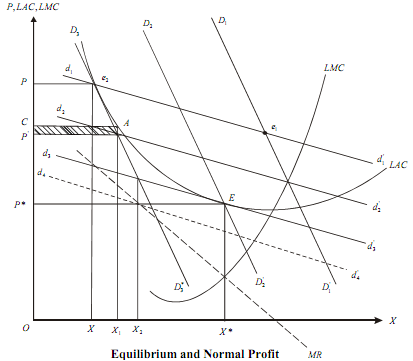

Chamberlin argued that in practice equilibrium is achieved by price adjustments of existing firms as well as new entry. Equilibrium is stable if the dd´ is tangent to the average cost curve and expected sales are equal to the actuals (i.e., the dd' curve cuts the DD´ at the point of tangency of dd´ and LAC). We start with the point e1 (see Figure), where there is abnormal profit. New firms are alternated until D1D1´ shifts to D3D3´. Some might take e2 as a long run equilibrium with (P, X) price output combination since only normal profit is earned these. However, this is not true. Each firm believes d1d1 is its demand curve and if prices are lowered, output sold goes up and hence profit will increase. However, each firm having the same incentive to reduce price. As a result, dd' slides down and each firm realises a loss instead of profit.

For example, see that at position d2d2´. The firm has reduced price to P´ but others have not done similarly and X1 is produced with a total loss equal to the shaded area CP'BA. Each firm still believes that it can achieve positive profit by cutting price. The loss infact increases further as d2d2´ slides down along D1D1´. The process would end when dd´ becomes tangent to the LAC. This will happen if the firms produce X*. However, still there are too many firms and their share is X2 (given by intersection of D3D3´ and d3d3´). Firms in order to achieve X* (to maximize profit since at X*, MR=MC) reduce price. As a result, d3d3 slides down further to the left and with increasing losses. The firms, which cannot bear this loss, quit D3D3' and move to the right to D2D2.

Exit will continue till d3d3' becomes tangent to LAC, and D2D2´ cuts d3d3´ at the point of tangency. The point E is the table equilibrium where (p*, X*) is the equilibrium price quantity combination. Firms earn normal profit and no entry or exit takes place.