Terms of Trade Argument:

One argument for adopting protectionist measures is based on cost-benefit analysis. This applies in the context of large countries. In the context of international trade a large country is one whose actions regarding the decision whether or not to restrict trade flows has direct repercussions on the world price of goods.

When a large country imposes import restrictions (say, via an import tariff), this serves to reduce world demand for the importable and thus the price of the importable good in the world market. That is, by imposing tariff restriction on imports, a large country is able to affect the price of foreign exporters. The tariff leads to a lowering of the price of imports and thus results in a terms of trade benefit for the country.

However this benefit must be compared with the cost of the tariff. As we will see in the next section, a tariff impacts on the price of the importable good and changes relative prices of the importable vis a vis the exportable goods. Thus the costs of a tariff are measured by the distortion in production and consumption incentives, associated with the change in domestic relative price ratios.

Under certain conditions it can be shown that the benefits of a tariff, due to the improvement in terms of trade, outweighs the costs of the tariff. This is the terms of trade argument for protectionism. In fact it can be shown that there exists a sufficiently small but positive tariff-rate, at which the terms of trade benefits outweigh the costs.

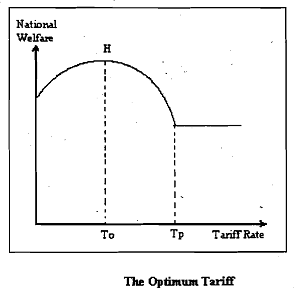

This means that at small tariff rates a large country's welfare is actually highe; as compared to a free trade situation. As the tariff rate is increased, however, the costs of protection begin to grow more rapidly than the'benefits. That is, the Welfare Curve, that relates national welfare to the rate of tariff rises initially, reaches a maximum and then turns downwards.

Tp is the prohibitive tariff rate. This rate is so high, that it completely prohibits all trade. So the country is actually worse off than with free trade. For, with free trade consumers would have had access to a wide variety of goods at lower prices. Tariff rates higher than Tp have no effect on social welfare, so the welfare curve is completely flat beyond this point.

The tariff rate To, corresponding to point H on the Welfare Curve, is the tariff rate at which national welfare is maximised. This tariff rate To is the optimum tariff. For a large country there is an optimum tariff To at which the marginal gain from improved terms of' trade just equals the marginal efficiency loss from production and consumption distortions. It can be ' shown that the optimum tariff rate is always positive but less than the prohibitive rate Tp.

Therefore the optimal policy in the export sector would be to impose a negative subsidy or a on exports that raises the price of exports in the world market. Like the optimum tariff, the optimum export tax is always positive but less that the prohibitive tax rate that completely reduces exports to zero. Note that the actual policy of oil exporters like Saudi Arabia has been to tax their exports of oil, raising the price of oil to the rest of the world.

A limitation of the terms of trade argument is that is does not apply to small countries that do not have price setting power in the world market.

Another shortcoming of this argument relates to its limited practical relevance. Consider the consequences, if large countries like the USA were to actually impose an optimal tariff, in a bid to gain from trade, at the expense of other trading nations. Obviously this would bring forth retaliatory action from other large trading partners, leading to a situation that would thoroughly undermine the commitment to free trade embodied in multilateral organisations like the WTO.