Williamson model of managerial discretion:

According to Williamson, managers pursue policies, which maximise their own utility rather than that of the owners. The managerial utility function depends on salary, security, power, status, prestige and professional excellence. Except salary, the rest of the variables are non-pecuniary and therefore need special treatment. In this model, the non-pecuniary variables are measured by means of "expense preference", which is defined as the satisfaction derived by the managers from certain types of expenditures. In particular, staff expenditures on emoluments and funds available for discretionary investment give managers a positive satisfaction because these are a source of security and reflect the power, status, prestige and professional achievement of managers. As staff expenditures, emoluments and discretionary investment expenses are measurable in money terms, they are used as proxy variables to replace the non-operational ones like power, status, prestige and professional excellence appearing in the managerial utility function. Thus, the utility function of the managers is given by:

U = f,(S,M,ID)

where S = staff expenditures, including managerial salaries (administrative and selling expenditure)

M = managerial emoluments.

ID = discretionary investment.

The Demand Curve of the Firm:

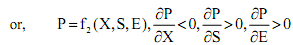

It is assumed that the firm has a known downward-sloping demand curve given by

where X = output, P = price, S = staff expenditure, E = condition of the environment (this represents autonomous factor that affect dd., resulting in the shift of dd.)

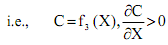

The production cost

Total production cost (C) is assumed to be an increasing function of output X

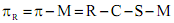

Actual Profit (π)

where R = revenue from sales, C = total production cost, S = staff expenditure

Reported Profit (πR)

R π is profit reported to the tax authorities. It is actual profit less managerial emoluments (M), which are tax deductible.

Minimum Profit (π0)

This is the amount of profits (after tax), which is required for an acceptable dividend policy by the shareholders. π0 is that which is essential to keep the shareholders satisfied.

∴ πR -T ≥ π

where T ⇒ tax function, given by

T = T +t.πR

⇒ T Lump-sum tax, t ⇒ marginal tax rate or, unit profit tax.

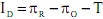

Discretionary investment (ID)

i.e., the amount left from the reported profit after subtracting the minimum profit and tax.