Bains limit pricing model -A:

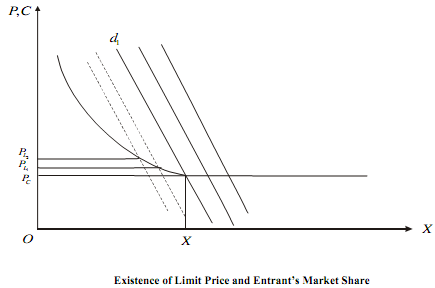

In this model, the entrant expects the established firms to keep their price constant at the pre-entry level and allow the entrant to secure any share it can have at this price.

The established firms will set the price at a level, which will make entry unattractive as per the following:

The premium E by which the limit price will exceed the competitive price, depends on four factors:

a) Initial share (d) of the entrant relative to the minimum optimum scale (say, ).

).

If  then there is no barrier to entry.

then there is no barrier to entry.

If d < , then the established firms will manipulate an E such that PL > PC. which is shown in Figure.

, then the established firms will manipulate an E such that PL > PC. which is shown in Figure.

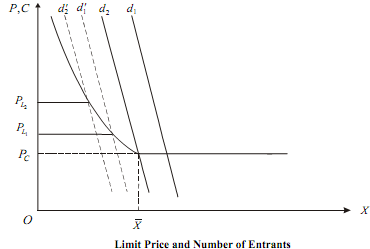

b) If entry occurs, then for all firms (new and old), the share of the market would be reduced. Therefore, greater the number of existing firms, N, the greater is E and higher will be PL . This is shown in Figure.

In Figure d1 is the pre-entry share of each firm. In the post-entry period, it shifts to d1 . Therefore, the entry-preventing price is set at PLi . If N is large, then the share of the firms (pre-entry) is d2 and hence limit price will be higher at PL2 .

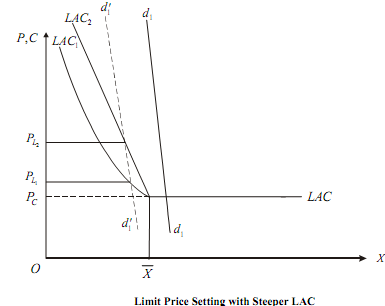

c) The steepness of LAC

The steeper the LAC curve is, the higher will be the premium and higher would be the limit price. This is shown in Figure with steeper LAC curve LAC , and the higher limit price P .

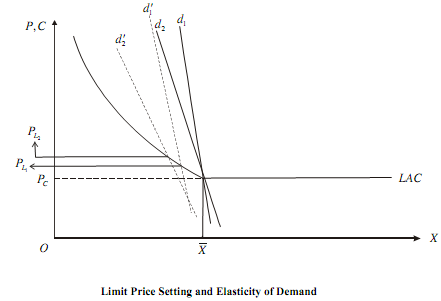

d) The elasticity of the market DD Curve.

Let us assume that the demand curve of the individual firms (d) has the same elasticity as the market demand curve DD. In that case, the greater the price elasticity, the higher is the premium and higher is the limit price.

The individual demand curve d2 is more elastic than d1. Accordingly, the limit price PL2 > PL1. In Figure, we see that if share of the entrant is d1 or any other to the right of d1, then no limit price would exist. For any share to the left of d1, there will be limit price.