Assumptions of Bain's Model:

1) For each industry there exists a minimum optimal scale of plant, say x

2) LAC is L-shaped i.e., costs remain constant beyond the minimum optimal scale

3) LAC is the same for all, the established firms and the potential entrant

4) The market-demand curve DD is known to all firms

5) All firms produce similar products, so that the preference-barrier is ruled out from this model

6) All firms have equal market shares. This implies that eventually the old and new firms will get an equal share of the pie

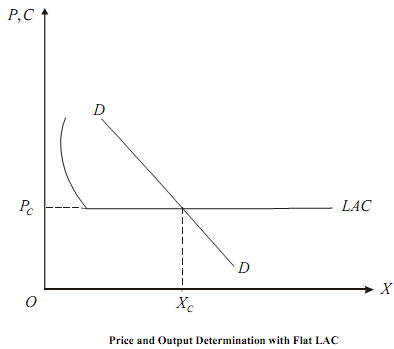

7) The flat part of the LAC curve determines the long-run (LR) competitive price, PC and output XC as given by the intersection of the two and is shown in the following Figure.

Economies of Scale:

Economies of scale may be real or pecuniary. Real economies are technical, arising out of efficient large-scale machinery or managerial or labour-related or greater specialisation of labour. Pecuniary economies arise from bulk buying at preferential lower prices: Lower transport costs when output is large, lower advertising etc.

Irrespective of the nature, the economies of scale create an important barrier to the entry. The effects on the level of the limit price depend on the expectations of the (i) entrants about the reactions of established firms after entry and (ii) established firms about the behaviour of entrants. Bain states the following, on whose basis he analyses his model:

1) The potential entrant expects the established firms to keep the post-entry price constant.

2) The potential entrants expect that established firms to retain their output at the pre-entry level.

3) The entrants expect that established firms will partly increase their output and will allow price to fall.