Absolute Cost Advantage:

The established firms enjoy an absolute cost advantage due to (a) skills of expert management personnel who are experienced (b) patents and superior techniques (c) control of the supply of raw materials and (d) lower cost of capital markets.

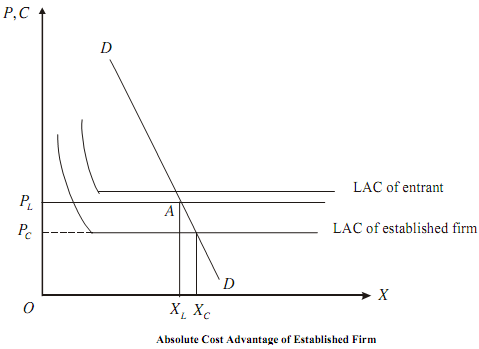

If any type of absolute cost advantage exists, then the LAC of the entrant would be higher at every scale of production than that of the established firms, as shown in Figure. As a result, an entry-preventing price like PL would be set at a level just below the cost of the potential entrant.

In the figure, DD is the market demand curve. The entrants demand curve, dd, is AD. At any level of output beyond OXL , the entrant's faces a loss, so that entry becomes unattractive. The difference,PL - PC, is the entry gap and shows the amount by which the established firms can raise the price above LAC without attracting entry.

Barriers from Initial Capital Requirements:

New firms require an initial capital outlay, which could be difficult to acquire. Banks may be reluctant to finance new business and the capital market could be almost inaccessible to the new firms.