Estimation and inference:

We have seen that the mathematical manipulation of economic models to arrive at a convenient estimating equation results in the creation of an estimating equation that is autoregressive.

Autoregressive models where a lagged value of the dependent variable appears on the right hand side of the equation but the error term is normal and independently distributed, as obtained by manipulation of the partial adjustment model, can be consistently estimated by ordinary least squares. However, the estimators will be biased because the lagged dependent variable is correlated with the disturbance term.

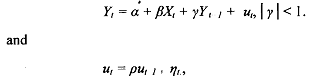

Dynamic models where a lagged value of the dependent variable appears on the right hand side of the equation and the disturbance term follows an autoregressive process, as obtained after manipulation of the Koyck model and the partial adjustment model, cannot be consistently estimated by ordinary least squares. Let us consider- a somewhat generalized form of the basic model outlined in equations.

where η, is distributed independent, normal with mean zero and variance σ2 , and lρl<l.

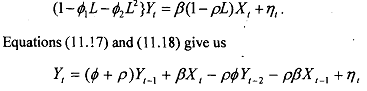

After some manipulation we saw that the model of equations can be written as

The equation may be estimated by ordinary least squares and a test run for the coefficient of Xt-1 = 0 and the coefficient of Xt ≠ 0. This is equivalent to a test for ρ = 0.

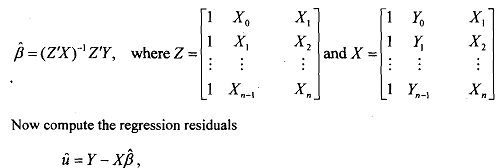

Various alternative. techniaues have been suggested. One serial and easy to use technique is that of instrumental variables. Wallis propbses the following procedure. Estimate equation using Xt-1 as an instrument for Yt-1 . This gives

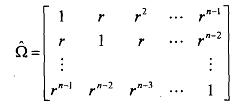

and calculate the first order serial correlation coescient = r = ρ'. Using this estimate of p obtain the matrix

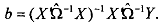

and compute the GLS (generalized least squares estimator)

This estimator is computationally simple and consistent. Of course, asp is unknown this is not an efficient estimator. Alternatively, one can use an iterative, non-iinear, least squares technique to estimate the parameters of equation. To do this lag equation by one period, multiply by p, and subtract from the original equation to obtain

Estimation of the above by iterative, non-linear, least squareswill give consistent and asymptotically efficient estimators. Hypothesis testing, for significance of variables, in these models uses standard t and F tests as in any other multiple regression model.