Economic theory and models with lags:

Economic theory has several models which lead to a similar final representation as the two models discussed above. The best known of these are the partial adjustment and adaptive expectations models.

partial adjustment model:

The partial adjustment model assumes that for redsons of ignorance, inertia, and the high cost of change agents are unable to adjust immeziately and fully to changes in their environnent. Consider an example where, Xt denotes the individual's disposable incomc and Y,* denotes the optimal expenditure corresponding to X,.

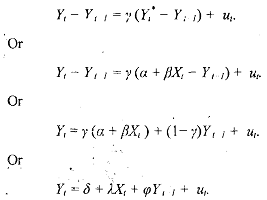

Suppose that there is a sudden and large change in the individual's income level. She will not be able to achieve the corresponding optimal consumption level immediately because she might not know enough about her utility function to adjust to the change at once. She may also be unable to respond immediately because of previous contractual arrangements (such as an existing apartment lease) which may constrain her immediate behavior. Therefore, her behavior may be modeled using a partial adjustment model of the form,

Equation assumes that consumption habits persist and consumption today is a weighted combination of last period's (Yt-1) consumption and present optimal ,consumption (α + βXi). The speed of adjustment and the relative importance of the two different consumption levels in the final consumption level depend on fhe partial adjustment parameter y. It is assumed thzt 0 < y ≤ 1. The closer y is to one, the faster consumers achieve optimal consumption levels. Values of y near zero, indicate highly persistent consumption patterns. Substituting yα = δ, yβ - A, and (1 -y) = β we get equation which is essentially equation, of the lagged dependent variable model, with thc addition of an intercept term.