Shapiro-Stiglitz Model:

Important features of the Shapiro-Stiglitz efficiency wage model is presented in the following:

Basic Setup

Let us assume that there are N identical, risk neutral workers. They face an instantaneous utility is a function of wages and effort 'normalised' as:

u(w, e) = w - e.

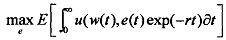

In the above equation e is ether Oor a constant e> 0 i.e., it is a binary variable and not continuous. The unemployed workers receive wage w ≥ 0 and the effort level e = 0. The worker leaves the job with separation rate per unit time b that is exogenous. Intertemporal interestldiscount rate is taken as r . The workers objective function is

We have the workers choice at any point in time in which she decides to exert effort or not. The odds of a worker getting caught if shirking are q . If fired, the worker enters unemployment, waits for a new job. The job finding rate, which will be determined in the equilibrium is a Asset Equations We consider that the value of employment is the flow value of the wage minus the capital loss of unemployment scale of its probability.

To appreciate the valuation problem, remember that a typical worker may transfer from the current state of unemployment to possible future state of employment. The rate at which this transfer occurs may depend on the individual's actions, in two states: One state being 'employed and working hard' and another being 'employed and taking it easy'. The model includes the following asset values:

Vu = Present discounted life time value of currently being unemployed

Vn = Value of currently being employed and working hard

Vs = Value of currently being employed and shirking.

When working hard, a worker puts up effort e and has productivity 1. When shirking, there is no effort and no productivity fiom this worker.

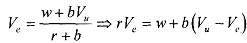

To find the asset value of employment, we take a short discrete time interval:

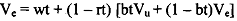

Notice we are for now taking V, as given, The wt term gives the flow of wages, and the second expression is the discounted value of future outcome, bearing in mind that

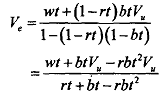

Rewriting above we get

Let us move to continuous time so that it allows t -> 0 and we write

In the above equation, notice that value of employment is the flow value of the wage minus the capital loss of unemployment scaled by its probability. We now want to consider this problem separately for a shirker versus non- shirker:

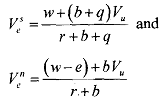

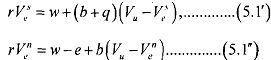

In (5.1') above, rv is the return to the asset vS assuming a common interest rate r . The first term on the right-hand side gives the current return to wage w for a shirking worker, who does not put up any effort. The second term is the expected value of the change in the asset, (b + q) (vu - vne) , where (b + q) is the total rate of change that occurs for a shirker remembering the fact that a shirker also suffers a probability q of being caug and then fired).

When a worker losses her job, Vu - VeS yields the asset change. In general, this change is negative as utility loss is associated wit losing ones job. h In case (5.1"). the first part of right side, i.e., we indicates the lower current return. Why? Because the worker puts up effort e while working hard, lowering thereby the current utility. In the second term, i.e., b(Vu- V"e), the capital loss is suffered with smaller probability as q is missing. Intuitively, this equation shows that if the worker is checked now, she keeps her job and continues receiving the return w - e .

we get