Insurance Market and Adverse Selection:

We repeat those results here by spelling out the problem explicitly, in principal-agent framework. You know that the insurance company has less information about the r.isks regarding illness of the insured than the insured individuals themselves.

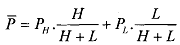

Suppose that there are two groups of individuals, the high-risk group (H) and the low-risk group (L). Take their probabilities of illness or accident as PH and PL with PH > PL. Both groups buy insurance and the company cannot distinguish them. The weighted average probability of illness for the whole group given by

In this formulation P, > > 4, . If the cost of illness is C, then the insurance premium I for a full coverage will be

If individuals know their own risks, since P' >PL, , the ones with low risk may not be willing to buy insurance whereas the high risk individuals would be willing to accept the offer. When low-risk agents drop out, the insurance company has to raise the premium, and only the high-risk individuals will buy the insurance. The low-risk individuals will go without any insurance.

To bye pass the problem, the insurance company can get the low-risk people to reveal themselves by offering coinsurance or some deductibility scheme. This process is known as "self-selection." Such a move will help the insurance company to infer the risk characteristics of individuals. However, the information problem in not completely solved. The information conveyed by the individual's choice of a particular contract depends on the set of contracts available to the individual.

With two groups of individuals with different probabilities of disaster (illness), there cannot, theoretically speaking, be a single insurance policy. If at all, there have to be two insurance policies, and it can be shown that the high-risk individual obtains complete insurance and the low-risk individual obtains only partial insurance.

We can incorporate other examples of adverse section as well. Try to consider the following:

Labour Contract: A firm may offer only low wage without knowing the potential workers, which will give rise to recruiting least productive workers. These are the types of workers who would be\willing to accept the offer made.

Financial Markets: A bank may fail to observe the risk-return characteristics of a project. Consequently, it will extend credit facilities to bad projects while rationing credit to good projects. For more instances of adverse selection you may also note the following contracts:

Landlord-Tenant Case: The landlord delegates the cultivation of his land to a tenant who will be the only one to observe the exact local weather condition (i.e., the private information)

Legal Attorney-Client Case: A client delegates her defence to an attorney who only has the private knowledge of the difficulty of the case.

Investor - Broker Deals: An investor would delegate the management of her portfolio to a broker, who only knows the market conditions.