Hidden Information Modelling:

The discussion of this sub-section is based on the lecture notes of Tian, G., (2005) prepared as a part of microeconomic theory. We have taken liberty of adopting the sequence and notation used in the note of the Sub-section 12 and borrowed freely the work. The information gap between the principal and the agent has some fundamental implications for the design of the contract they sign. For an efficient use of economic resources, some information rent must be given up to the private agent holding information. Thus, we look for second-best solutions in the contract. In such a situation the principal trades off his desire to reach allocative efficiency by giving information rent to the agent to induce information revelation.

The main objective of this section is to find the optimal rent extraction efficiency trade-off faced by the principal. We seek to find the mechanism of designing his contractual offer to the agent under the set of incentive feasible constraints: incentive and participation constraints. In general, incentive constraints are binding at the optimum, showing that adverse selection clearly impedes the efficiency of trade.

Consider a consumer or a firm (the principal) who wants to delegate to an agent the production of q units of a good. The value for the principal of these q units is S(q) where S' > 0, S" < 0 and S(0) = 0.

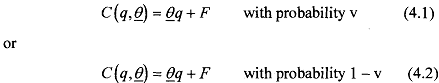

The production cost of the agent is unobservable to the principal, but it is known that there is a fixed cost F and the marginal cost belongs to the set  . The agent can be either efficient (θ) or inefficient (θ') with respective probabilities v and 1 - v. That is, she has the cost function

. The agent can be either efficient (θ) or inefficient (θ') with respective probabilities v and 1 - v. That is, she has the cost function

Denoted by  the spread of uncertainty on the agent's marginal cost. This information structure is exogenously given to the players.

the spread of uncertainty on the agent's marginal cost. This information structure is exogenously given to the players.