Statement of Cash Flows

The importance in secretarial income statements is the willpower of the net proceeds of the firm. Perhaps the most important item that can be extracted from financial statements, however, is the firm's actual cash flow. Cash flow is normally related to accounting profit, which is merely net income as reported on the income statement, but it is not the same. Although companies with relatively high accounting profits generally have moderately high cash flows, the relation- ship is not always perfect. Therefore, investor is worried about cash flow projections as well as accounting earnings projections.

Since the value of any positive feature, counting a share of stock, depends on the cash flow bent by the benefit, manager should act to maximize the cash flow obtainable to its provider of resources (stockholders, bondholders, etc.) over the long run.

A business's cash flow is equivalent to cash from sales, minus cash in commission costs, minus attention charges, and deficiency taxes. Before we continue further, however, we need to revisit depreciation, which is an in commission cost, but not a cash expend.

Consider that reduction is an annual charge alongside income, which reflect the predictable dollar cost of the capital apparatus used up in the production process. For example, suppose a machine with a life of 7 years and a zero predictable salvage value was purchased in 2002 for $210,000. This $210,000 cost is not expensed in the purchase year; rather, it is charged beside production over the machine's seven-year depreciable life. If the depreciation expenditure were not taken, profits would be overstated, and taxes would be too high. So, the annual reduction charge is deduct from sales

revenues, along with such other expenses as labor and raw materials, to determine chargeable income. However, because the $210,000 was in reality exhausted back in 2002; the reduction thrilling against income in 2003 through 2009 is not a cash expend, as are labor or raw resources charges. Reduction is a noncash charge, so it must be added back to net income to gain the cash flow from operations.

Firms can be thought of as having two disconnect but associated sources of accounting value: existing assets, which supply current proceeds and cash flows, and growth opportunities, which symbolize opportunities to make new investments that will ultimately increase future profits and cash flows. The ability to take advantage of growth opportunities often depends on the availability of the cash needed to buy new assets, and the cash flow from obtainable assets is often the primary source of the funds used to make profitable new savings. This is another reason why both investor and managers are concerned with cash flow as well as proceeds.

Net working capital is distinct as existing assets minus current liabilities. The values of existing assets and current liabilities are on the balance sheet. The statement of cash flows uses the change in net working capital from year to year. Net working capital is optimistic when current assets are better than current liability. In this case, the cash that will become obtainable from assets over the next year exceed the cash that must be salaried out.

Current Asserts Current Liability Networking capital

Year ($ millions) ($ millions) ($ millions)

2000 382 145 237

1999 415 112 303

In addition to devote in permanent asset, a firm can devote possessions in net working capital. This incremental investment is called the change in net working resources. The change in net working capital is the difference between the net working capital in the preceding year and the net working capital in the present year. In the container of Timberland, alter in net working capital is $237 - $303, or -$66 million. The change in net working capital is more often than not positive in a growing firm. Hence, the dissimilarity must be finance with some long-term foundation of capital, such as debt or equity. Thus, look at the change in net operational capital in isolation; one would take for granted Timberland did not experience growth in 2000 and did not need extra finance.

Cash flow is not the same as net working capital. For example, escalating inventory require use of the firm's cash. Because both inventories and cash are current assets, this conjecture does not affect net working capital. In these circumstances, an augment in a particular net working capital account, such as account, decreases cash flow.

Comparable to the association that the worth of a firm's assets is equal to the value of the liabilities and the value of the equity, the cash flows from the firm's possessions (that is, its in commission activities), CF(A), must equivalent the cash flows to the firm's creditors, CF(B), and equity investor, CF(S):

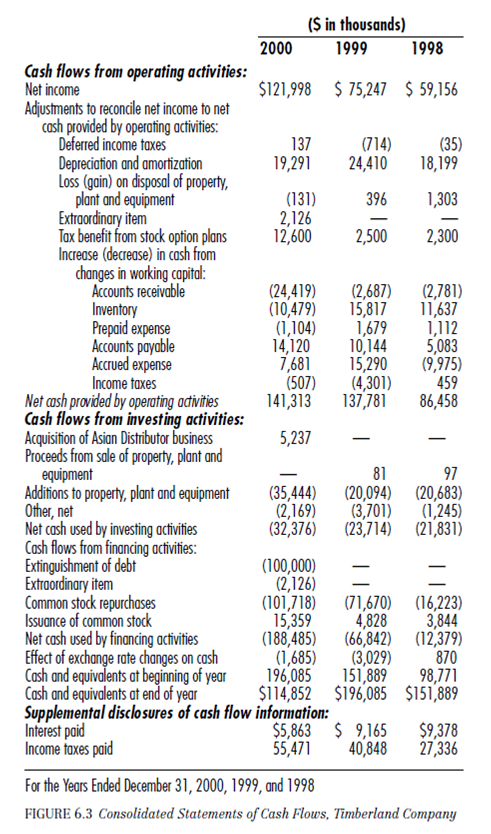

The first step in formative a firm's money flow is to gauge the cash flow from operation. As can be seen in the declaration of cash flows for Timberland (see Figure), operating cash flow is the cash flow generate by business activities, including sales of merchandise and armed forces.

For our purposes, it is practical to divide cash flood into two classes: (1) other cash flows and (2) operating cash flows. Operating cash flows arise from ordinary operations, and they are, in spirit, the differentiation between sales revenues and cash operating cost, including taxes paid. Other cash flows arise from the issuance of stock, from borrowing, or from the sale of fixed possessions. Our focus here is on operating cash flow.

In commission cash flow can be different from secretarial profits (or net income) for three primary reasons:

1. All the taxes reported on the income statement may not have to be paid during the current year, or, under convinced circumstances, the actual cash payments for taxes may go beyond the tax figure deducted from sales to compute net income.

2. Sales may be on credit, and hence not stand for cash.

3. Some of the expenses (or costs) deduct from sales to determine profits may not be cash costs. For example, reduction is not a cash cost.

Thus, in commission cash current could be better or slighter than secretarial profits throughout any given year.

In commission cash flow reflect tax expenditure, but not financing, capital expenditure, or changes in net operational capital. Accountants compute operating cash flow by preliminary with the net proceeds found on the profits statement. They then add back any noncash operating cost, such as reduction, and decide the change in net working capital. This total shows the amount of cash brought into the business from the operation of the firm.