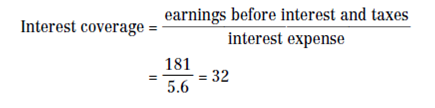

Interest Coverage

The ratio of interest coverage is intended by dividing earnings (before interest and taxes) by inquisitiveness. This ratio emphasizes the capability of the firm to generate enough income to cover interest expenditure. This ratio for the Timberland Company in 2000 was:

The ratio of attention coverage is straight related to the capability of the firm to pay its invariable interest obligations. However, it would almost certainly make sense to add reduction to income in compute this ratio and to comprise other financing operating cost, such as payments of principal and lease payments. These adjustments would provide a better calculate of the cash available to repay all of the firm's current financial obligations.

A large debt burden is a problem only if the firm's cash flow is insufficient to make the necessary debt service payments. This is connected to the doubt of future cash flows. Firms with conventional cash flows are normally said to have more debt aptitude than firms with elevated, vague cash flows. We see this is the case with Timberland, because their interest reporting ratio is 32. Therefore, it may be practical to calculate the unpredictability of the firm's cash flows. One probable way to do this is to calculate the standard deviation of cash flows relative to the average cash flow. Note, however, that this is done using historical information while it is really the unpredictability of future salary that matter to creditors.