Cash Flow from Financing Activities

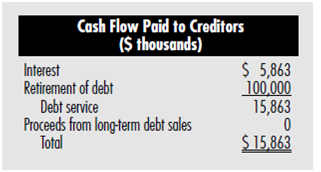

Cash flows to and from creditors and owners comprise changes in evenhandedness and debt. The total outflow of cash of the firm can be alienated into cash flow paid to creditors and cash flow paid to stockholders. Creditors are paid an amount usually referred to as debt service. Debt service consists of curiosity payments plus any repayments of principal (that is, retirement of debt).

An important source of cash flow is from advertising new debt. Thus, an augment in long-term debt is the net consequence of new borrow and refund of maturing obligations plus attention expense. Timberland's net working capital is not growing and it has not sold new debt, but has retired old debt. Thus one would presume the business is not growing.

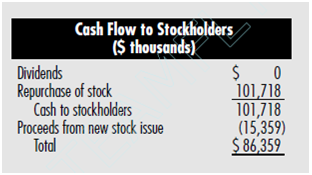

Cash stream (flow) of the firm also is remunerated to the stockholders. It consists of paying dividend plus repurchasing outstanding shares of supply (shares of stock not owned by the company itself) and issuing new shares of stock.

A number of significant annotations can be drawn from our discussion of cash flow:

1. Many types of cash current are pertinent to a total sympathetic of the firm's financial circumstances. Operating cash flow, defined as wages before interest and depreciation minus taxes, measures the cash generate from operation not counting capital expenditure or working capital necessities. It should usually be encouraging; a firm is in trouble if in commission cash flow is negative for a long time because the firm is not generate enough cash to pay in commission costs. Total cash flow of the firm includes adjustments for capital spending and additions to net working capital. It will often be unconstructive. When a firm is growing speedily, expenditures on accounts receivable and permanent assets can be higher than cash flow take from sales.

2. Total income is not cash flow. The net income of the Timber- land Company in 2000 was $122 million, whereas money flow was $126 million. The two numbers are not usually the similar. In determining the economic and financial situation of a firm, cash flow is more pertinent.