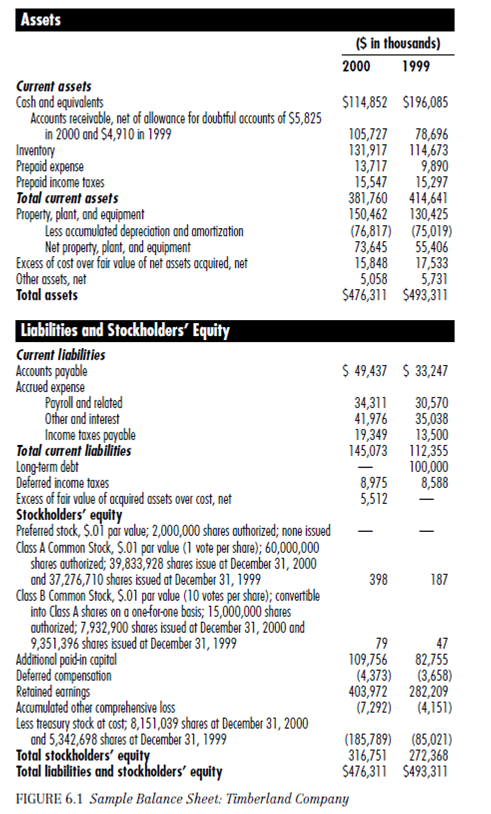

The Balance Sheet

The balance sheet also called the "statement of financial condition," is an accountant's photograph of the firm's assessment. In short, the balance sheet shows everything the company owns as well as everything the company owes to exterior parties. A banker may look at a balance sheet to determine the firm's creditworthiness. A contractor may be more interested in the amount owed to suppliers- "accounts payable." This may point to the universal rapidity of expenditure to its distribute. Many users of economic statements, including managers and investors, want to know the true worth of the firm. This is not found on the equilibrium sheet since many of the true capital of the firm do not emerge on the balance sheet: good management, proprietary resources, constructive economic circumstances, and so on. These factors all add worth to the firm, but will by and large not appear as an "asset" on the firm's balance sheet.

The balance sheet is ready on a particular date, as if the firm were temporarily frozen. The equilibrium sheet states what the firms owns and how it is financed. It has two sides: on the left are the assets, and on the right the liability and stockholders' equity. The accounting meaning that underlie the balance sheet is

Assets = liabilities + stockholders' equity

We have put three-line parity in the balance equation to specify that it must always hold, by definition. The stockholders' impartiality is therefore defined to be the difference between the assets and the liabilities of the firm. In principle, evenhandedness is what the stockholders would retain after the firm discharged its other financial obligation.