In US, savings and loan associations constitute the major originating group of the traditional loans. What types of properties can be mortgaged? Virtually all forms of real estate can be mortgaged, though they fall into several categories: Residential and Non-residential, etc. The traditional mortgages exhibit the following features:

-

A fixed rate of interest is charged on the loan for its entire term.

-

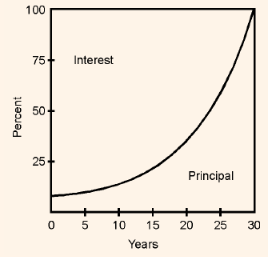

Loan is repaid in equated monthly installments consisting of both principal and interest. At first, the mortgage payments are mostly interest payments. As the principal outstanding declines, the interest portion of the monthly payments also declines and the principal portion increases.

Consider a 30-year 10% traditional mortgage for a loan of $100,000. The monthly payment and the break up between principal and interest will be as under:

Table 1: Traditional Mortgage (10% Interest Rate, 30-Year Term)

|

Month

|

Mortgage Balance at the end of the Month

|

Monthly Payment

|

Interest

|

Principal

|

|

0

|

1,00,000.00

|

|

|

|

|

1

|

99,955.76

|

877.57

|

833.33

|

44.24

|

|

2

|

99,911.16

|

877.57

|

832.96

|

44.61

|

|

3

|

99,866.18

|

877.57

|

832.59

|

44.98

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

|

100

|

93,135.76

|

877.57

|

776.96

|

100.61

|

|

101

|

93,034.32

|

877.57

|

776.13

|

101.44

|

|

102

|

92,932.04

|

877.57

|

775.29

|

102.28

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

|

300

|

41,303.22

|

877.57

|

348.60

|

528.96

|

|

301

|

40,769.84

|

877.57

|

344.19

|

533.38

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

|

358

|

1,733.44

|

877.57

|

21.57

|

860.00

|

|

359

|

870.32

|

877.57

|

14.45

|

863.12

|

|

360

|

0

|

877.57

|

7.25

|

870.32

|

Note: Each month, the interest payment is 1/12 of 10% of the mortgage balance at the end of the previous month. The principal payment is the total payment less interest. Total payment is the equated monthly payment calculated as

100,000 ¸ PVIFA(10/12,360).

Table 1 illustrates the break down of interest and principal components. At first, the mortgage payment is mostly interest and it gradually decreases as maturity approaches and on maturity, the payment is entirely the principal.

The amount of principal outstanding at any time is referred to as the mortgage balance. The amount of a home's value that is owned is referred to as homeowner's equity. The difference between the current market value of the home and the mortgage balance equals the homeowner's equity and as the mortgage balance declines, the equity rises.

Figure 1: Monthly Mortgage Payments -

Interest/ Principal (30-year, 10% Conventional Loan)

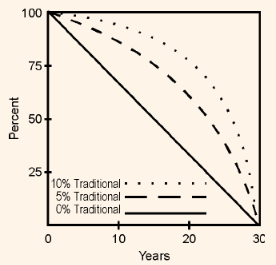

Figure 2: Examples of Mortgage Balances for Various Loans

Figure 2 shows how the mortgage balance for several possible loans would decline over a time period.