Goods Market and the IS Curve

The IS curve shows the combinations of interest rates and levels of output such that planned spending equals income. In order to derive the IS curve, first we will have to drop the simplifying assumption made earlier of investment being autonomous. We will have to consider explicitly the determinants and the functional form of investment.

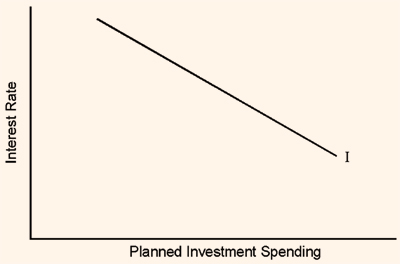

Investment is spending on additions to a firm's capital, such as machines, or buildings. Typically, firms borrow to purchase investment goods. The higher the interest rate for such borrowing, the less they will be willing to borrow and invest. Conversely, firms will want to borrow and invest more when interest rates are lower. Let us assume that the investment spending function is of the form

Where i is the rate of interest and θ measures the responsiveness of investment to changes in interest rate.  denotes autonomous investment spending, that is, independent of both income and interest rate.

denotes autonomous investment spending, that is, independent of both income and interest rate.

From the equation it can be seen that the lower the interest rate, the higher is the planned investment and vice versa. Figure 5.1 shows the investment schedule. The schedule shows the amount of planned investment expenditure for various levels of interest rates.

Figure

Derivation of the IS Curve

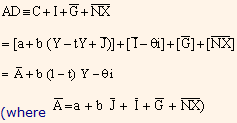

First of all, we will have to modify the aggregate demand function of the earlier chapter to reflect the new planned investment spending schedule.

For equilibrium in the goods market

Y = AD

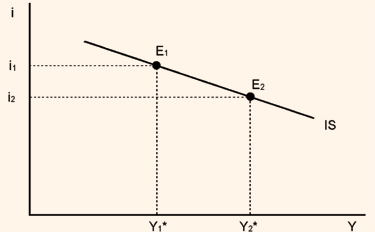

From the above equation we can see that when the interest rate increases, the equilibrium output decreases and vice versa. The set of combinations of income (Y) and interest rates (i) which represent the equilibrium in the goods market is called the IS curve.

Figure 5.2 (a)

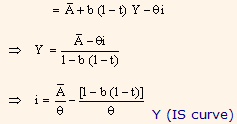

We can draw the IS curve using a different approach.

Figure 5.2 (b)

In the upper part of figure 5.2, we have shown two aggregate demand schedules corresponding to two different rates of interest. When the interest rate is i1, the aggregate demand schedule AD1 cuts the 45o line at E1 and the corresponding equilibrium income in Y1*. This combination of interest rate i1 and income Y1*gives rise to an equilibrium in the goods market and is shown in the lower part of figure 5.2, by the point E1. When the interest rate falls from i1 to i2, the investment demand increases as a result of lower interest rate. This pushes up the aggregate demand curve upwards and is shown by AD2. AD2 cuts the 45o line at E2. The output Y2* corresponding to the point E2 is an equilibrium output when the interest rate is i2. i2 and Y2* are shown in the lower part of the figure by point E2. In a similar manner, other combinations of interest rates and income which produce goods market equilibrium can be got. Joining all these points gives us the IS curve.

Now, let us derive some important properties of the IS curve. The equation of the IS curve is

| since the multiplier |

|

|

|

|

|

|

|

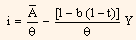

we can rewrite the equation of the IS curve as

From the above equation it can be seen that the steepness of the IS Curve depends on the multiplier ( α ) and investment sensitiveness to changes in interest rates ( θ ). We see that if θ is large, then the IS Curve would be flat because  would be small. It can also be inferred that larger the multiplier, the flatter would be the IS curve. Since the slope of the IS Curve is dependent on the multiplier and the multiplier in turn is dependent on fiscal policy - more specifically, the tax rate 't' - we see that fiscal policy can affect the slope of the multiplier. An increase in the tax rate would reduce the multiplier, which in turn increases the steepness of the IS Curve. Thus, the steepness of the IS Curve and the tax rate go in the same direction.

would be small. It can also be inferred that larger the multiplier, the flatter would be the IS curve. Since the slope of the IS Curve is dependent on the multiplier and the multiplier in turn is dependent on fiscal policy - more specifically, the tax rate 't' - we see that fiscal policy can affect the slope of the multiplier. An increase in the tax rate would reduce the multiplier, which in turn increases the steepness of the IS Curve. Thus, the steepness of the IS Curve and the tax rate go in the same direction.

Now, let us see the effect of an increase in autonomous expenditure of the IS Curve. An increase in autonomous expenditure would increase the term  in the equation for IS curve and thus an increase of

in the equation for IS curve and thus an increase of  . A rise in

. A rise in  would mean an outward shift, that is to the right, of the IS Curve. Thus, for example, an increase in autonomous government expenditure would result in an outward shift of the IS Curve.

would mean an outward shift, that is to the right, of the IS Curve. Thus, for example, an increase in autonomous government expenditure would result in an outward shift of the IS Curve.

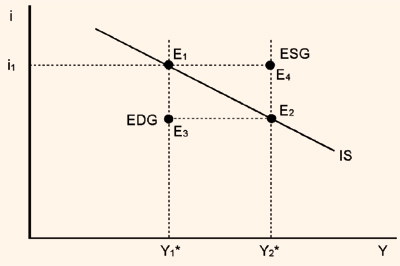

We can sharpen our understanding of the meaning of the IS Curve by considering points off it - that is points not on the IS Curve.

Figure 5.3

Now, in figure 5.3 points E3 and E4 are disequilibrium points because they do not lie on the IS Curve. What are the properties of points E3 and E4? Let us first consider point E3. Point E3 has the same level of income as point E1, but the interest rate is lower. Therefore, the demand for investment is higher at E3 than at E1. Consequently, the aggregate demand is higher at E3than at E1. Since at E1, an equilibrium point, quantity demanded is equal to quantity produced, at E3 quantity demanded will have to be greater than quantity produced. Thus at E3, have excess demand for goods and services over what is supplied. What applies to E3 applies to all points below the IS Curve as well. A similar reasoning can be used to show that at all points above the IS Curve, we have excess supply of goods, that is, aggregate demand is less than output.