The circular flow of income in an open economy

An open economy is one in which international trade exists. Assume also that there is government spending and taxation.

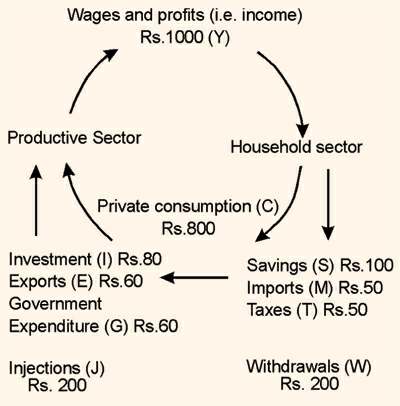

Thus households need not consume all of their income. Some may be saved (S), spent on imports (M), or taxed (T). So the savings (S) and imports (M) and taxes imposed (T) are known as "withdrawals" (W) or "leakages" from the actual flow. An increase in withdrawals (W) will reduce the level of output and income (Y).

However, Y will be added to investment (I), government spending (G) and money spent by foreigners on exports (X). These are known as "injections" (J).In an open economy the size of Y is determined by the size of AD, which is determined by C + I + G + X.

Over a period of time there are withdrawals (W) from the income flow. If individuals save, then the income is taken out of the circular flow. If an economy's income is Rs.1,000 and it saves Rs.200, then only Rs.800 is passed on as expenditure. Other withdrawals are taxes and imports. The latter represent a loss of income from the domestic economy to some overseas economy.

Alongside withdrawals there are also injections (J) into the flow of income. These are in the form of investment, government spending and exports, savings withdrawn and used to finance investment, either directly through the purchase of capital goods or indirectly via financial institutions such as banks. Thus, the original withdrawal or savings ends up as an injection elsewhere in the system. Taxes end up as government spending on goods and services. Exports are financed from spending made by other countries. This spending enters into the circular flow as an injection of income.

In this economy

Y = AD

Therefore, Y = C + I + G + X

Y= C + J

Where J equals injections i.e. I, G and X.

For equilibrium we require all withdrawals to equal all injections i.e. W = J. If injections are greater than withdrawals then the level of national income (i.e. total incomes) will rise, and vice versa.