Q. Show the AD curve over time?

With inflation, AD curve will no longer be stable over time. In its place, it will glide upwards or downwards at a rate determined by growth rate of the money supply ΠM. Let's look at the case ΠM = 10%.

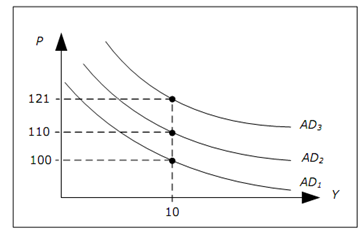

If AD1 is AD curve in year 1, AD1would show us all combinations of Y and P where both markets are in equilibrium in year 1. For instance, both markets are equilibrium at point A where P = 100 and Y = 10.

Figure: AD curve glides if ΠM≠ 0

In year 2, money supply is higher - it has increased by just 10%. If P had increased by 10%, then this new value of P together with the level of GDP we had last year would still give us equilibrium in both markets. Inflation has then been 10% and none of the LM or IS curves have shifted.

In year 2, P = 110 and Y = 10 should be on AD2. In year 3, by same arguments, P = 110.1.1 = 121 and Y = 10 should be on the AD3 and we see that AD curve glides upwards by 10% per year - exactly the same rate as growth in the money supply.

We should remember that if ΠM ≠ 0, then AD curve is applicable only for a given point in time. At another point in time, we should draw a different AD-curve. The rate at which AD curve glides is equal to ΠM - if ΠM is high, a higher inflation is essential if the same level of GDP is to lead to equilibrium in both markets.

Even though ΠM determines evolution of the AD curve over time, there are still many combinations of Y and P leading to equilibrium in the goods- and money market (all points on the AD curve at specifically the given point in time). Only one point will be an equilibrium point for the entire economy and as before, AS curve will help us to find this point.