The Short Run versus long Run

- Short-run:

- Period of time in which the quantities of one or more production factors cannot be changed.

- These inputs are called as fixed inputs.

- Long-run

- Amount of time required to make the entire production inputs variable.

Observations:

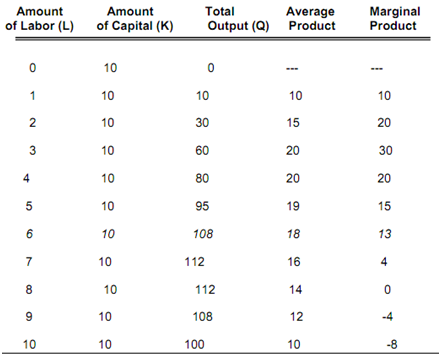

1) With the additional workers, output (Q) increases, reaches the maximum limit, and then decreases.

2) The average product of labor (or AP), or output per worker, increases 1st and then decreases.

3) The marginal product of labor (or MP), or output of additional worker, increases quickly initially and then decreases and becomes negative.

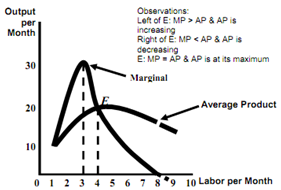

Observations:

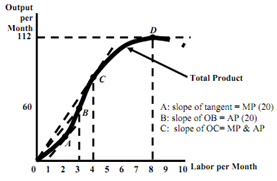

- When MP = 0, TP is at the maximum

- When MP > AP, AP is gets increased

- When MP < AP, AP is gets decreased

- When MP = AP, AP is at the maximum

AP = slope of line from the origin to a point on TP, lines b, and c.

MP = slope of a tangent to any point on the TP line, lines a and c.