Sensitivity Analysis

The only certain thing is that nothing is sure thing. Cost structures can be anticipated to vary over the time period. Management should vigilantly analyze these changes to manage the task profitability. CVP is very useful for studying sensitivity of the profit for shifts in set costs, variable costs, sales volume, and sales price.

1. Changing Fixed Costs

Changes in fixed costs are possibly the simplest to analyze. To verify a revised break-even level needs the new total fixed cost be spitted by the contribution margin? Let's return to the instance we took for Leyland Sports. Recall one of the original break-even calculations/computations:

Break-Even Point in Sales = Total Fixed Costs / Contribution Margin Ratio

$2,000,000 = $1,200,000 / 0.60

If Leyland added a sales manager at a predetermined salary of $120,000, the revised break-even will come out to be:

$2,200,000 = $1,320,000 / 0.60

In this case, the fixed cost rose from $1,200,000 to $1,320,000, and sales should reach the $2,200,000 to break even. This increment in break-even means that the manager requires to produce at least $200,000 of an additional sales to give reason for their post.

2. Changing Variable Costs

While recruiting the new sales manager, Leyland became interested in an aggressive person who was willing to take the post on a "4% of sales" commission-only basis. Let's see how this would affect the breakeven point:

Break-Even Point in Sales = Total Fixed Costs / Contribution Margin Ratio

$2,142,857 = $1,200,000 / 0.56

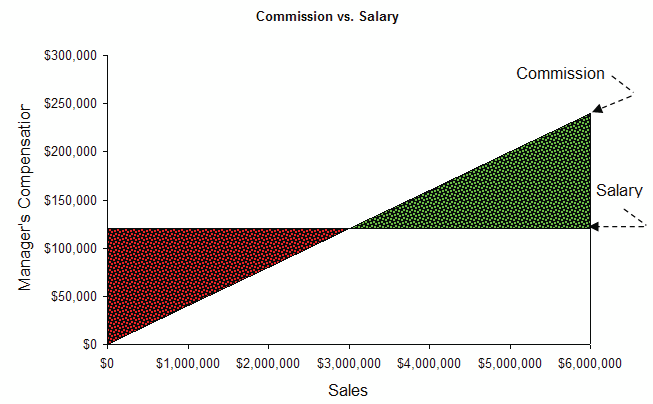

This calculation makes use of the revised contribution margin ratio (60% - 4% = 56%), and develops a lower break-even point than with fixed salary ($2,142,857 vs. $2,200,000). But, do not suppose that a lower break-even describes the better choice! Think that the lower contribution margin will "stick" no matter how high sales go. At the above extremes, the total compensation cost will be much

more with the commission-based scheme. The below drawn is the graph of commission cost versus salary cost at the various levels of sales. You can see that the commission starts to go beyond the fixed salary at any point above $3,000,000 in sales. In fact, at $6,000,000 of sales, the manager's compensation is twice as high if commissions are given in lieu of the salary!

What this analysis cannot tell you is that how an individual will behave. The sales manager has much more incentive to perform, and the added commission might be just the ticket. For instance, the company will make more at $6,000,000 in sales than at $3,000,000 in sales, even if the sales manager is paid twice of the amount. At a predetermined salary, it is difficult to predict how well the manager performs, since pay is not tied to the performance.

You have most likely marvelled at the salaries of some movie stars and the professional athletes. Rest assures that some serious CVP analysis has gone into the agreement negotiations for these celebrities. For instance, how much additional revenue must be generated by the movie to justify casting a high dollar movie star versus using the low-cost non popular actor? And, you have possibly read about deals where musicians get a percentage of revenue from ticket sales and concessions at the concert they perform. These arrangements are expected based on detailed calculations; what might seem foolish is actually very much logical in terms of a comprehensive CVP analysis.

3. Blended Cost Shifts

At times, a business will consider changes in fixed and variable costs. For instance, an airline is considering the purchase of the new jet. The new jet entails a more fixed cost for the equipment, but is much more fuel efficient. The proper CVP analysis needs the new fixed cost be spitted by the new unit contribution margin to decide the new break-even level. Such testing is essential to evaluate whether a rise in fixed costs is justified.

To illustrate, suppose Flynn Flying Service at present has a jet with the predetermined operating cost of $3,000,000 per year, and a contribution margin of 30%. Flynn is offered a swap for a new jet which will cost $4,000,000 per year to operate, but produce the 50% contribution margin. Flynn is expecting to produce $9,000,000 in revenue every year. Should Flynn create the deal? The answer we obtain is yes. The break-even point on the old jet is $10,000,000 of revenue ($3,000,000/0.30), while the new jet has an $8,000,000 break-even ($4,000,000/0.50). At $9,000,000 of revenue, the new jet is beneficial while progressing to use the old jet will end in a loss.

4. Per Unit Revenue Shifts

Thus far, the discussion has decided on cost structure and the changes to that structure. Another approach for changing the contribution margin is via changes in per the unit selling prices. So long as these adjustments are made without affecting fixed costs, the results can be dramatic. Let's go back to the Leaping Lemming, and see how a 10% rise in sales price would affect the contribution margin and profitability for 20X2.

LEAPING LEMMING CORPORATION

Income Analysis for the 20X2 at Alternative Pricing

Observe that this 10% rise in price results in a doubling of the contribution margin and a tripling the net income. Bingo: the solution to rising profits is to raise prices while maintaining the existing cost structure -- if it were only this simple! Customers are responsive to pricing and even a bit increase can drive customers to competitors. Before raising the prices, a company should consider the "price elasticity" of the demand for its product/goods. This is fancy jargon to describe the easy reality that demand for a product will fall as its price rises.

So, the major question for Leaping Lemming is to assess how much volume drop can be absorbed when prices are raised. The suitable analysis requires dividing the continuing predetermined costs (plus target or current net income) by revised unit contribution margin; this results in the needed sales (in units) to maintain the current level of the profitability. For Lemming to attain a

$500,000 profit level at the revised pricing level, it would require to sell 5,000 units:

Units to required to Achieve the Target Income

=

(Total Fixed Costs + Target Income) / Contribution Margin Per Unit

5,000 Units = ($500,000 + $500,000) / $200

If Lemming sells at least 5,000 units at $1,100 per unit, it will build at least as much as it would by selling 10,000 of the units at $1,000 per unit. The unfamiliar is what customer response will be to the

$1,100 pricing decision. Number of a business has fallen prey to the presumption that they could raise prices with the impunity; others have scored homeruns by getting away from such increases.

5. Margin Beware

Some contracts offer for "cost plus" pricing, or similar arrangements which seek to provide the seller with an guaranteed margin. These agreements are projected to allow the seller a normal and fair profit margin, and no more. Though, they can have unintended consequences. Let's assess an instance. Pioneer Plastics sells the trash bags to Heap Compacting Service. Heap and Pioneer have entered into the agreement which provides Pioneer with a contribution margin of 20% on 1,000,000 bags.

Initially, the bags were likely to cost Pioneer $1 each to produce, in addition a fixed cost of

$100,000. Though, increases in petroleum products necessary to produce the bags skyrocketed, and Pioneer's variable production cost was in fact $3 per unit. Let's see how the Pioneer faired under their contract:

|

|

$1 Scenario

|

$3 scenario

|

|

Sales

|

$ 1,250,000

|

$ 3,750,000

|

|

Variable costs (1,000,000 X $1 vs. $3)

|

1,000,000

|

3,000,000

|

|

Contribution margin (20% of sales)

|

mce_markernbsp; 250,000

|

mce_markernbsp; 750,000

|

|

Fixed costs

|

100,000

|

100,000

|

|

Net income

|

mce_markernbsp; 150,000

|

mce_markernbsp; 650,000

|

Observe the astounding change in Pioneer's net income - $150,000 versus $650,000. Such "cost plus" agreements should be carefully constructed, else the seller has little incentive to do something but let costs creep up. At times you will hear a company complain about the cost hike negatively affecting their "margins;" before you guess the worst, take a nearer look to see how bottom line is being impacted. Even if Pioneer granted to cut Heap a break and reduce their margin in half, their bottom line benefit would still soar in the illustration.

6. Margin Mathematics

In the previous illustration, the contribution difference was 20% of sales. Consequently, variable costs are 80% of the sales. If entire variable costs are $1,000,000, then sales would become $1,250,000 ($1,000,000 divided by 0.80).