1. Overview and Learning Objectives

This formative assignment seeks to develop and assess skills associated with basic modern ICT tools and competence in the techniques of Rough-Cut Capacity Planning and Financial Appraisal in the context of manufacturing systems engineering.

These skills will be developed through original thought and the use of library investigations, course notes, and general-purpose office software to:

• Calculate the load generated by a projected sales forecast on a company’s resources;

• Suggest a level of capacity needed to meet this load

• Perform a financial appraisal of the proposed system

• Produce a report documenting the processes used and making a recommendation for management action.

2. Scenario, data and tasks

2.1. Scenario and objectives

A small producer of specialist vehicles is building a new workshop to meet expected demand for its products over a period of 5 years. The workshop will contain three workcentres, each capable of a different process.

One of the company’s managers has been asked to:

• Predict the workload on the new workcentres

• Recommend how many units of resource to provide in each workcentre

• Predict the level of utilisation expected on each workcentre

• Appraise the likely financial performance of the workshop

Luckily, the manager has been provided with some clear data and knows the relevant analysis methods.

Putting yourself in the manager’s position, tackle the tasks that follow.

3. Rough-Cut Capacity Planning (RCCP): data and tasks

3.1. Data 1

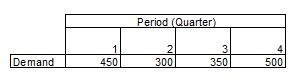

Expected quarterly sales in Year 1 (vehicles)

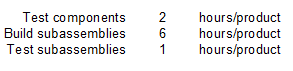

The work content of a single unit of each product in each process has been estimated at:

3.2. Task 1

Using MS-Excel, calculate the workloads on each workcentre, expressed in actual quarterly, total annual and average quarterly terms.

3.3. Task 2

Using a stacked vertical barchart in MS-Excel, display the total workload on the workshop for each quarter, broken down further to each workcentre.

3.4. Data 2

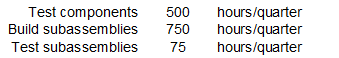

The ideal quarterly capacity of a single unit of each resource in each workcentre, assuming full efficiency is:

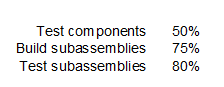

In other installations, the actual, historically observed efficiency of these resources has been:

3.5. Task 3

Taking into account the probable efficiencies of the resources, calculate and display in a table the effective quarterly capacity of a single unit of each resource.

3.6. Task 4

Based on your answer to Task 3, calculate the “ideal” number of units of resource each quarter (i.e. the number of units of resources in each workcentre that would just meet the workload).

3.7. Task 5

What would be a practical number of units of resource in each workcentre that would allow capacity to go all through the year unchanged? (Assume that demand timing is flexible [i.e. demand can be levelled between quarters] and that capacity can be rounded up to the average quarterly level.)

3.8. Task 6

What would be the resulting quarterly and annual utilisations in each workcentre?

4. Financial Appraisal: data and tasks

NOTE: Use MS-Excel as appropriate to tackle Tasks 7 to 10.

4.1. Data 3

The new workshop adds €10 to the value of each item that passes through it (i.e. the internal value to the company of a finished subassembly exceeds the associated total cost of materials and processing for one subassembly by €10).

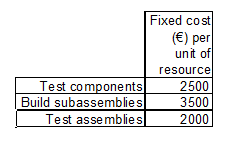

Each item of equipment for the new workshop has fixed costs associated with it – these must be paid “up front” before any parts are processed. These costs have been estimated as follows:

4.2. Task 7

What is the total fixed cost of the capacity plan proposed in Task 5?

4.3. Task 8

What is the total value added by the new workshop in Year 1 of the 5-year plan?

4.4. Task 9

Assuming that the average quarterly demand is maintained over the remaining years of the 5-year plan, what is the payback period of the new workshop, to the next higher whole quarter?

4.5. Task 10

Graphically show the cumulative net cash flow for each quarter of the project period. Does this match your calculation from Task 9?

5. Discussion and recommendation

5.1. Task 11

Based on what you know about demand, customer flexibility and financial appraisal, discuss your findings and recommend a course of action.

Consider, for example, and among other things:

• Is the assumption of levelled demand feasible in the modern world?

• Is the “flat capacity” strategy used here a sensible one? What others might be employed to deal with fluctuating demand? What alternatives to capital installation might the be?

• Is annual demand likely to stay steady for 5 years just to make analysis simple? Is simple payback analysis the only one that can be used, or are there others?

• How would your analysis change to deal with short-term fluctuations and rising trends?

• Ultimately, what form would you recommend the company’s investment in the workshop to take?