1. You are given the following long-run annual rates of return for alternative investment instruments:

- US Government T-Bills 3.5%

- Large-cap common stocks 12.1%

- Long-term corporate bonds 6.2%

- Long-term government bonds 5.6%

- Small-capitalization common stock 14.6%

The annual rate of inflation during the period was 2.9%. Compute the real rate of return on these investment alternatives.

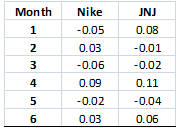

2. The following are the monthly rates of return for TECO Electric and Gold Hill

Using an excel spreadsheet, compute the following:

a. Average monthly rate of return for each stock

b. Standard deviation of returns for each stock

c. Covariance between the rates of return

d. The correlation coefficient between the rates of return

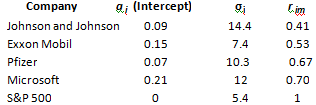

3. Based on five years of monthly data, you derive the following information for the companies listed:

a. Compute the beta coefficient for each stock

b. Assuming a risk free rate of 5 percent and an expected return for the market portfolio of 12 percent, compute the expected (required) return for all the stocks.

c. Plot the following estimated returns for the next year on the SML and indicate which stocks are undervalued or overvalued.

- Johnson and Johnson-15%

- Exxon Mobil-10%

- Pfizer-13%

- Microsoft-20%

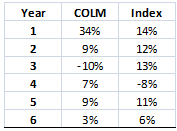

4. The following are the historic returns for the Columbia Sportswear Company (COLM) and the General Index:

Based on this information, and using an excel software, compute the following:

a. The correlation coefficient between COLM and the General Index.

b. The standard deviation for the company and the Index

c. The beta for the COLM.