Q. Report on bank's predicts of exchange rates?

Report on banks' predicts of exchange rates.

The three banks have produced extensively differing forecasts which even involve forecasts of exchange rates moving in opposite directions from the current spot rate.

The banks' forecasts are probable to differ because of

- Different models utilize by the banks to produce the forecasts. Models may be based on technical analysis or fundamental analysis. Technical analysis engages the use of charts of past price movements to try to establish future trends. Fundamental analysis usually involves economic/econometric modelling based upon past and current economic and financial information.

- Different suppositions about the economic and other variables that influence future exchange rates. For instance the banks could easily have different views on the future level of inflation, interest rates, economic growth, government spending, unemployment, taxation, balance of payments, international capital movements or other key economic indicators.

There is nothing odd about banks producing different forecasts of exchange rates.

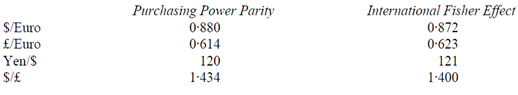

The financial information would propose the following expected one-year spot exchange rates based upon Purchasing Power Parity or the International Fisher Effect.

Even these usual economic explanations of exchange rates give conflicting evidence suggesting that the markets are in disequilibrium. For instance the inflation rate in the UK is lower than in the US suggesting that the £ will strengthen relative to the $. Nevertheless interest rates in the UK are higher than in the US suggesting that the £ will weaken relative to the $. The forecasts of the banks are considerably different from the above predicts suggesting that the banks have used other models to predict future exchange rates.

If foreign exchange markets are well-organized future foreign exchange rates will result from new relevant information reaching the market. At the current time this information is unknown. Who can predict a natural disaster such as a drought, flood or earthquake or even when a change in government will occur? Future economic information is as well not known. When announced economic information often differs from market expectations and will result in changes in exchange rates.

The kind of exchange rate system that exists will influence the ability to forecast future exchange rates.

Generously floating exchange rates are the most difficult to forecast as they directly respond to economic events and relevant new information. If governments interfere in the currency markets in a managed float unless the intervention rules are known then accurate forecasts are impossible even if the rules are known the size of the currency markets make it difficult for governments to protect currency values against speculative attacks. At the other severe fixed exchange rates where one currency is pegged to another (often the US dollar) should in theory be easier to forecast. Regrettably fixed exchange rates don't remain fixed forever; devaluation or revaluation is common as inflation and interest rates between the two countries diverge. Among fixed exchange rates the direction of a possible change in rates is quite easy to predict but not the exact time devaluation or revaluation would take place or the magnitude of any change in values.

Correct forecasts of future exchange rates are very difficult if not impossible. Key economic variables and political developments etc. will offer information at the present time on the likely direction and magnitude of movement in exchange rates. Nevertheless events change quickly and current expectations may be reversed by unpredictable future events.