Rational Expectations- Inflation Unemployment Trade-off:

Now, consider what happens if we suppose that workers have rational expectations about the rate of inflation First, this implies that, depends on information available to workers in any period t denoted by I(t), it is possible to define an objective probability distribution for the rate of inflation in the economy in period t + 1. Thus, there exists a conditional probability density function.

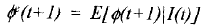

The rational expectation hypothesis then implies that

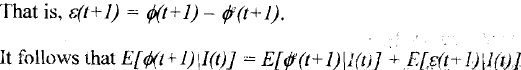

suppose ε(t+1) presents the deviation of the actual rate of inflation

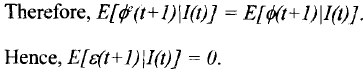

Suppose we consider the conditional probability distribution of the prediction error for the rate of inflation in period t+1, ε(t+1), , given that the set of' information I(t) is available in period t. If, workers do not make systematic errors in prediction, like I consistently predicting a value higher than the actual or a value lower than the actual, 1 then for a sufficiently large number of predictions based on the same information set, the average error in prediction must be zero.

Thus, if workers have rational expectations about the rate of inflation, the expected rate of inflation of workers can never consistently underestimate the actual rate of Inflation. In fact, over the long run, the sum of positive prediction errors for workers 1must be equal to the sum of negative prediction errors.