XYZ Co. manufactures automation machinery according to customer specifications. The company is relatively new and has grown each year. XYZ Co. operated at about 75% of practical capacity during the year 2009/10. The operating results for the year ended June 30, 2010 appear below:

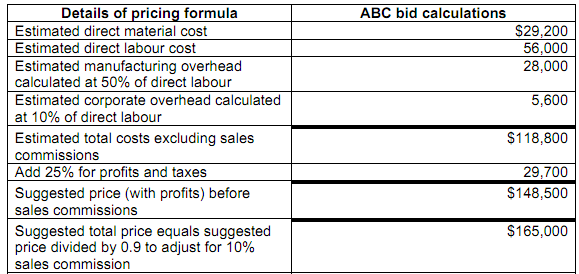

Top management of XYZ Co. want to have a more organised and formal pricing system to prepare quotes for potential customers. Therefore, it has developed the pricing formula (below). The formula is based on the company's operating results achieved during the year 2009/10. The relationships used in the formula are expected to continue during 2010/11. The company expects to operate at 75% of practical capacity during the upcoming year, 2010/11.

ABC Inc. has asked XYZ Co. to submit a bid on custom designed machinery. XYZ Co. used the new formula to develop a price and submitted a bid of $165,000. Details of the bid price are shown below:

1] Calculate the impact the order from ABC Inc. would have on XYZ Co.'s net profit after taxes if XYZ Co.'s bid were accepted.

2] Assume ABC Inc. has rejected XYZ Co.'s price but has stated it is willing to pay $127,000 for the machinery. Should XYZ Co. manufacture the machinery for the counter-offer of $127,000? Explain your calculations.

3] Calculate the lowest price at which XYZ Co. can supply this machinery without reducing its net profit after taxes. Explain your calculations.

4] Produce a revenue statement to explain how the profit performance for the year ended June 30, 2010 would be affected if XYZ Co. accepted all its work at prices that adopted an approach that equated to the $127,000 counter-offer described in item 2. You should also advise management whether this is a good (i) short-term, and (ii) long-term strategy.