Problems of Common Property Resource

A common property resource is potentially subject to congestion, depletion or degradation when its use is pushed beyond the limit of sustainable yield. Hardin (1968) called the problem of CPR as the 'tragedy of the commons'. He brought out the problem by illustrating it through the metaphor of shepherds and the size of their herds. It is in the self-interest of individual shepherds that they increase the size of their herds, as it will generate more profits. Eventually the overall sheep population will exceed the pasture's (the common's) regeneration capacity. As a result, the pasture area will shrink and degenerate. While Hardin explained the problem through a lucid example, it holds true for all natural resources which do not have well-defined property rights.

There are three variables involved: i) the quantity of the resource (let us call it C for commons), ii) the rate of replenishment of the resource (Rr), and iii) the rate of use of the resource (RU). Whenever RI, exceeds Rr we have a tragedy. If C is too large and Rl1 is too small the depletion of the resource is so slow that it is not noticed and it is not viewed as a tragedy. However, with the passage of time as population size increases, there is an increase in R, and the depletion is perceptible.

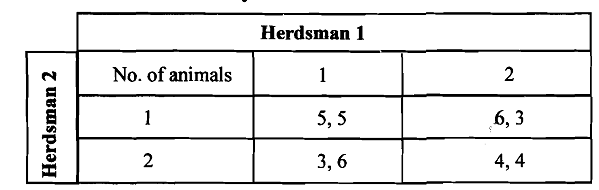

The tragedy of the commons can be represented by the formal framework of the 'prisoner's dilemma’ (PD) game. This game has a peculiar characteristic, which makes it an excellent representation of an important class of social phenomena. It brings out that the problem of social aggregation is not so simple. There are situations when everyone may suffer loss even if every individual acts rationally. Let us consider the case of two herdsmen who must decide on the number of animals to let pasture on a common land (belonging to both). To further simplify the presentation, let us assume that the choice facing each herdsman is between letting one or two animals on the common land. If both herdsmen choose to have one animal each, each of them gains $ 5. If, however, both choose to have two animals each on the common land, these animals will be underfed and will lose much of their economic value. As a result, the total gains each, herdsman may expect for having two animals pasturing is $ 4. Finally, if one herdsman has only one animal on the common land, and the other has two, their gains are $ 3 and $ 6 respectively. This situation can be summarised by entering the different gains, called payoffs, in a double entry matrix, as shown in he below table, where the first number in each cell is the payoff accruing to herdsman 1, while the second number refers to herdsman 2.

Table: Pay-off Matrix for the Herdsmen

It is easy to see that each herdsman will choose the strategy 'put two animals'. Such a strategy is called a dominant strategy (maximising own benefit), since the optimal action for one player does not depend on the strategy followed by the other player. Here each player has a dominant strategy so that the Nash equilibrium of the game comes out naturally as the one where each player chooses to put two animals on the common land. Here lies the tragedy of the commons: even though it would be better for both herdsmen to put only one animal on the commons (Pareto-superior outcome), it is individually rational for each of them to put two animals, and the Pareto-inferior outcome obtains. Here ‘the rational individual cannot obtain the collective output and maximising individual benefit will lead to collective ruin, where societal benefit will not be maximised.

Hardin, however, fails to make the distinction between situations of no property (open access) and situations of common property. His model is best fit for the situations of no property or open access and not the situations of common property. Therefore, the tragedy of the commons is a pessimist conclusion posed by Hardin. The two key assumptions of prisoner's dilemma model - players choose in ignorance of each other's choices, and each player chooses only once before the payoffs are received - become responsible for such pessimist conclusion.