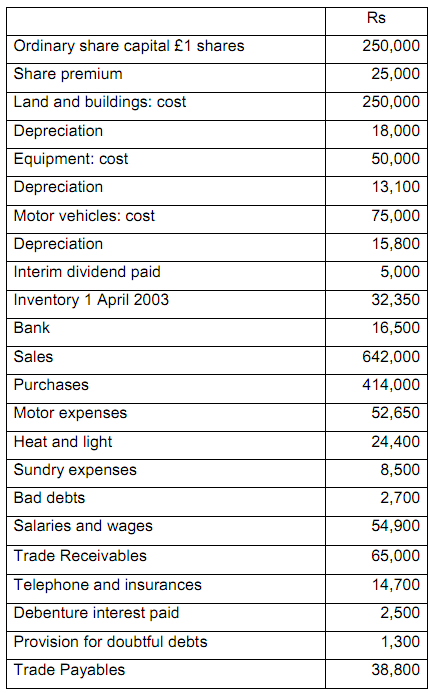

Dillings Ltd is a wholesaler and distributor of catering of office equipment. The following list of balances was extracted from its books at 31 March 2004:

The following additional information should be taken into consideration:

(i) The cost of inventory at 31 March 2004 amounted to Rs 34,200.

(ii) The provision for doubtful debts is to be adjusted to 3% of customers debts.

(iii) At 31 March insurances prepaid amounted to Rs 370 and unpaid bills were motor expenses, Rs 1,600 and electricity Rs 1,350.

(iv) Company policy is for depreciation to be provided for on Land & Buildings at 4% (reducing balance), Motor vehicles at 25% (reducing balance) and on Equipment at 10% of cost of assets in use at the year end. The charges for the year are to be provided for.

(v) The directors propose to transfer £3,000 to Reserves and that a final dividend of 5% be paid on the ordinary shares.

(vi) Corporation taxes on the year's profits are expected to be £10,000 and have not been provided for.

Required:

a) Prepare the Income Statement for the year ended 31 March 2004.

b) Prepare the Balance Sheet as at 31 March 2004.

c) Briefly explain how the amount of any dividend payable on the ordinary shares of a limited company may be determined by the directors.

d) What do you understand by the accounting term prudence?