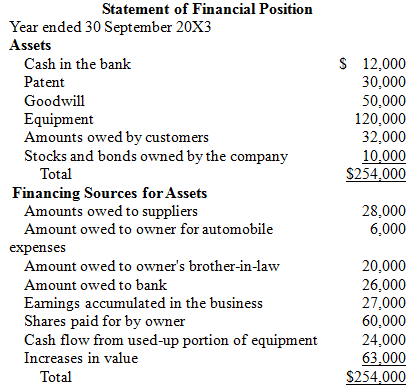

Prime Essentials Limited is a small private corporation. The owner plans to approach the bank for an additional loan or a line of credit to facilitate expansion. The company bookkeeper, after discussion wit h the owner of the company, has prepared the following draft SFP for the fiscal year ended 30 September 20X3, the company's first full year of operations:

The bookkeeper has provided some notes on the amounts included in the draft SFP:

1.The owner invested $60,000 of his own money to start the business.

2.The patent was purchased from the owner's brother-in-law for $17,000. The owner believes that the patent could easily be sold for $30,000, and probably more.

3.The equipment is being depreciated at the same rate as allowed for income tax. Depreciation represents a source of financing for the company because it is added back to net income and increases the operating cash flow.

4.The owner uses his personal automobile for occasional business errands. He estimates that the company owes him $6,000 for his use of his personal car.

5.Because the business has been profitable from the very first, the owner estimates that he could sell the company at a $50,000 premium, thereby almost doubling his initial investment after only one year.

6.The bank gave a five-year loan to the company, with the provision that the company had to maintain a 25% "compensating balance" in its cash account until the loan is repaid.

7.The company holds some publicly-traded shares in other companies. The value of these securities was $10,000 when the owner's brother-in-law gave them to the company as a loan on 1 April 20X3 by. On 30 September 20X3, their market value was $14,000. The company is free to sell the securities, but $10,000 plus one-half of any proceeds above $10,000 must be passed on to the brother-in-law. The brother-in-law also lent $10,000 cash to the company, repayable on demand.

8.One of the customers is a bit unsteady, financially. That customer owes $3,000.

Required:

Redraft the SFP. Provide an explanation for each change that you make. Explain any note disclosures that you think are needed.