Using the data provided in Appendix 1 prepare an analysis for the attention of the directors of Meridian Ltd. The analysis should highlight the strategic differences between the conventional and activity based costing. Your analysis must also include a critical review of the theory and a summary table of the key values.

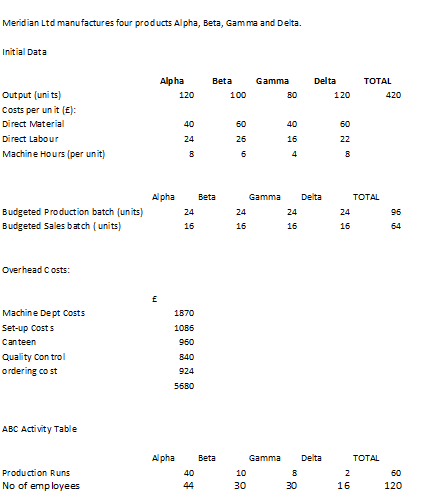

Appendix 1

Solution:

Analysis of Conventional and ABC Costing -

ABC Costing is a more accurate way of determining overhead costs per unit than the conventional costing system. The conventional costing system uses a single driver for cost i.e. labour cost per unit or direct labour hours etc. However, in case of ABC Costing system the overhead costs are allocated to the units produced based on the actual cost driver for each cost i.e. canteen expenses can be allocated on the basis of employees, quality control costs can be allocated on the basis of production runs etc.

For the purpose of analysing the differences between conventional and ABC Costing systems, we have considered the following drivers for the purpose of allocating overhead costs under each method as below -

Conventional System - The overhead costs are allocated on the basis of direct labour cost only.

ABC Costing System - The overhead costs are allocated on the basis of following cost drivers -

Machine Department Costs - on the basis of machine hours per unit

Set Up Costs - on the basis of budgeted production batch units

Canteen expenses - on the basis of number of employees

Quality Control - on the basis of production runs

Ordering Costs - on the basis of budgeted sales batch units

Summary table of overhead cost per unit -

|

Overhead Cost per unit

|

Conventional £

|

ABC £

|

|

Alpha

|

14.50

|

17.06

|

|

Beta

|

15.71

|

12.78

|

|

Gamma

|

9.67

|

13.32

|

|

Delta

|

13.29

|

10.76

|

The summary table above highlights the overhead cost per unit for the products Alpha, Beta, Gamma and Delta. The overhead costs per unit as per ABC Costing system are accurate than the conventional costing system and only these costs should be considered for the purpose of preparation of financial statements of the business.