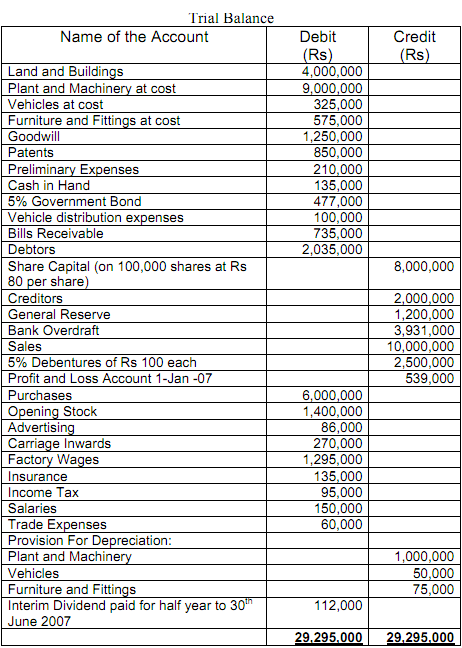

Alexandria Co. Ltd has an authorized capital of Rs 25,000,000 divided into 250,000 equity shares of Rs 100 each. 100,000 shares were issued to public and Rs 80 per share were paid. The ledger shows the following balances on 31st December 2007.

1) Sundry Debtors include an item of Rs 35,000 due from customer who has become insolvent and nothing could be recoverable from him. Provide 2.5% for doubtful debts on debtors.

2) Wages for the week ended 31st December 2007 amounted to Rs 115,000 which were paid on 14thJanuary 2008.

3) A Commission of 1% on the amount by which sales exceeds Rs 5,000,000 is payable to staff.

4) Closing Inventory was valued at Rs 2,000,000.

5) Depreciate on their written down value:-

Plant and Machinery by 5%;

Vehicles by 10%;

Furniture by 3

%

6) Amortize:-

Patents over 10 years;

Goodwill over 30 years

7) Write off the preliminary expenses through the Income statement.

8) Amount paid in advance were: insurance - Rs 17,000 and advertising bill - Rs 19,500.

9) Directors proposed the following appropriations:

a) Final dividend at 5% on paid up capital.

b) Transfer of Rs 150,000 to General Reserve.

Required:

(a) The Income Statement for the period ending 31st December 2007 as per the "function format" of the International Accounting Standard (IAS 1).

(b) The Balance Sheet as at 31st December 2007 as per the IAS 1. Showing the statement of changes in equity.