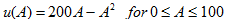

Pattie-Lynn's utility function for total assets is,

in which A represents total assets in thousands of dollars.

(a) Graph Pattie-Lynn's utility function. How would you classify her attitude toward risk?

(b) If Patty-Lynn's total assets are currently $10,000, should a bet in which she will win $10,000 with probability 0.6 and lose $10,000 with probability 0.4 appear favorable?

(c) If Patty-Lynn's total assets are currently $90,000, should the bet given in (b) appear favorable?

(d) Compare your answers to (b) and (c) . Does Patty-Lynn's betting behavior seem reasonable to you? How could you intuitively explain such behavior?

Using a sequence of simple lotteries (two or three will suffice), assess your own utility function over the range [-$10,000, +$100,000]. Show the lotteries you use, and plot the results.

Faced with a simple lottery with a 0.75 probability of winning $1000 and a 0.25 probability of losing $4000, what is your expected utility for the lottery?