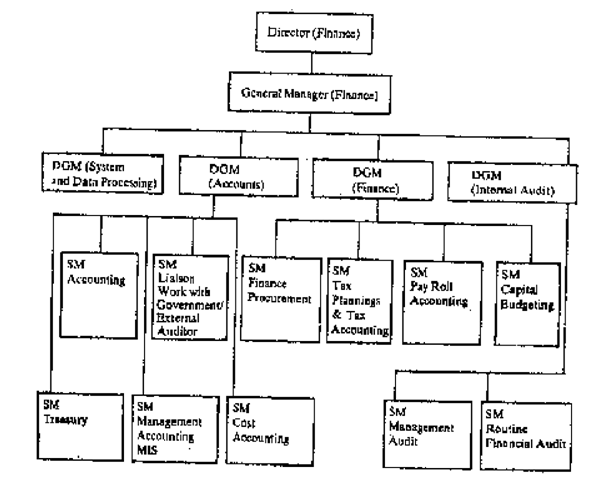

A characteristic organization chart for finance and accounting function is presented in following figure 2. You will notice the person at the helm of affairs the Director of Finance, who is a member of the Board of Directors. Reporting to him may be one or more general managers. If there is merely one General Manager, he may be implemented as General Manager of Finance or General Manager of Finance and Accounts, or Controller or Financial Controller. In a huge company four or five as demonstrated in figure 2, Deputy General Manager in-charge of various areas as systems finance, data processing, accounts and internal auditing may report to him. Subsequent the American pattern, a tendency has newly been observed among large companies, particularly in the private sector, to designate General Manager of Finance as President of Finance, or Finance and Accounts and a Deputy General Manager like Vice-president. All of these Deputy General Managers is assisted through a number of senior managers who look after various components of similar activities, for illustrations: financial accounting, administration and tax planning management auditing etc. Management audit is a comprehensive review of the various sub- systems of the organization as structure and goals, technical system, objectives, personnel policies, as well as succession planning, coordination and control policies and processes, adequacy and effectiveness of communication system. This category of audit is usually complete through a team of people comprising the internal resource persons drawn from different functional regions and external management consultant.

DGM = Deputy General Manger; SM = Senior Manger

Figure: Organization Chart for Accounting and Finance

We hope you currently have a reasonably superior concept of what accounting is, what its future is, and what are the various types of activities that are usually included in accounting. When fundamental functions of finance and accounting are performed in all kinds of organizations, their relative emphases or relevance might be different in differ types of organizations. Maintaining this in view we have prepared an audio programmed "Accounting and Finance Function in various Types of Organizations" and we suggest here you to listen tape. It will not only augment your familiarity along with the fundamental aspects and functions of accounting although will also develop your appreciation for relative divergences.