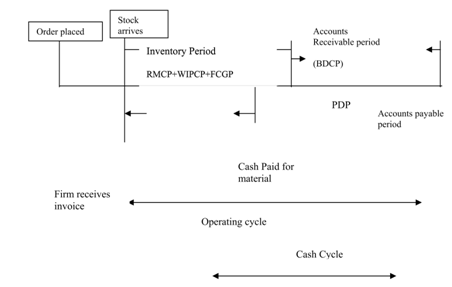

Operating cycle considers to the average time lapse among the acquisition of raw material and the final cash realization. This notion is used to determine the needs of cash working capital to meet the operating expenses. Here figure 3 depicts the cash cycle and the operating cycle.

Figure: Operating cycle

By the above figure you can simply estimate that the time that lapses among the purchase of raw material and the set of cash for sales is termed to as operating cycle, while the time length among payment of raw material purchases and collection of cash for sales is considered to as cash cycle.

The inventory period in the operating cycle comprises:

(i) RMCP that is Raw Material Conversion Period that is the time gap among purchase of raw material and the issuance of raw material for production.

(ii) WIPCP i.e. Work in Progress Conversion Period that is the time gap among issuance of raw material and the transfer of raw material in finished goods.

(iii) Finished Goods Conversion Period i.e. FGCP that is the time gap among sale of goods and the conversion of completed goods by shop floor to the warehouse.

(iv) Book Debt Collection Period i.e. BDCP that is the time gap between realisation and sales of cash

Currently the length of the operating cycle for direct material can be computed as given below:

Gross operating cycle = RMCP+WIPCP+FGCP+BDCP

Net Operating Cycle = Gross Operating Cycle - PDP

= RMCP+WIPCP+FGCP+BPCP-PDP

Here PDP is the Payment Deferral Period; it is the credit time extended through suppliers to pay for the purchases.