Investors are always interested in estimating the price sensitivity of a bond to change in market interest rates. Let us study how prices change both in terms of percentage price change from the initial price, and the rupee price change from the initial price.

-

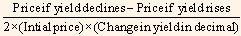

Approximate Percentage Price Change: The percentage price change can be determined by calculating the average of the percentage price change resulting from an increase and a decrease in interest rates of the same number of basis points. When percentage price change for a 100 basis point change in yield is calculated, it is referred to as duration. For, duration is a measure of the price sensitivity of a bond to a change in yield. Formula for estimating the approximate percentage price change for a 100 basis point change in yield is as follows:

Illustration

Price if yield decreases by 20 basis points = Rs.95.5

Price if yields rise by 20 basis points = Rs.92.2

Initial price = 90

Change in yield in decimal = 0.002

Substituting these values in our formula we get:

Approximate percentage price changes =

= 9.17%

So, if the duration of a bond is 9.17, we can interpret it as the approximate price change if yields change by 100 basis points is 9.17%. Similarly, the approximate percentage change in yield for 50 basis points in yield is 4.59%.

ii. Approximating the Rupee Price Change: Let us consider our earlier illustration. Let us say that bond XYZ has duration of 9.17. If the portfolio manager owns bonds whose market value is Rs.50,00,000, then for 100 basis point change in yield, the approximate rupee price change would be equal to 9.17 times of Rs.50,00,000, i.e. Rs.4,58,50,000. Similarly, for a 50 basis point change, the approximate rupee change would be Rs.229,25,000. The approximate rupee price change for a 100 basis point change in yield is referred to as the rupee duration.